Be taught intimately about FICO rating vs. credit score rating to handle your financials appropriately and at all times keep on the inexperienced facet in terms of private borrowings, bank card functions, or mortgage requests.

No single credit standing company gives a credit score rating for a person legitimate all through the world. Lenders contact numerous credit standing corporations for credit score reviews to make the ultimate determination of granting the funds.

Creditworthiness checking is a profitable enterprise, and there are numerous contributors like Experian. TransUnion, Equifax, and many others., with its personal fashions and credit score report names. Proceed studying to find numerous credit standing reporting fashions, their underlying calculation strategies, and variations on this final information for FICO rating vs. credit score rating.

What Is a Credit score Rating?

The monetary lending establishments understand how accountable you might be along with your debt and credit with the assistance of a credit score rating. Such a rating is a numerical illustration of your monetary well being. When the credit score rating is excessive, you borrow and repay on time. Quite the opposite, once you battle to repay debt obligations, the rating dips.

Credit score unions like Equifax, Experian, and TransUnion acquire info for a person or a enterprise on the next headers to calculate a credit score rating:

- Id like social safety quantity (SSN), identify, date of delivery, and many others.

- An itemized checklist of loans, bank cards, and credit score traces.

- Public information like chapter filings, judgments from courts, and lien.

- Prior credit score file requests from companies and people.

All of the three huge credit score unions within the USA use completely different creditworthiness fashions to allot a credit score rating. Therefore, you’ll at all times discover completely different credit score rankings from completely different institutes on the identical enterprise or particular person.

The Which means of Completely different Credit score Rating Ranges

Underneath 350 credit standing means no credit score historical past. You should communicate with a lender to get them to challenge you a personalised credit score account with a snug compensation plan.

300 to 579 denotes a extremely deteriorated credit score historical past. The person may need did not pay on time for a lot of credit score accounts. In case you can repay all of the money owed with curiosity, you might be able to restore such credit score rankings.

580 to 669 credit score rating is a good vary. Lenders could give you new credit score accounts, however the underlying curiosity will probably be larger.

In case your credit standing is between 670 to 739, you might be in good standing. Nonetheless, you could discover it difficult to get unsecured loans at aggressive rates of interest.

While you pay all of the payments like bank cards, utilities, auto insurance coverage, and lease on time, you possibly can safe a 740 to 799 credit standing.

800 to 850 credit standing signifies you’re a low-risk borrower, and you haven’t any dents in your credit score accounts’ historical past. You’ll qualify for the bottom rates of interest for any credit score account within the USA.

What Is a VantageScore?

The three main shopper credit score bureaus, Experian, TransUnion, and Equifax, created the VantageScore (300 to 850) creditworthiness calculation technique in 2016 to get rid of the monopoly of the FICO scores.

In FICO rating vs. credit score rating, the VantageScore performs a significant position in reporting somebody’s credit score rankings and serving to the person enhance their scores when obligatory.

Calculation Methodology for VantageScore

When calculating this rating for a credit score applicant, credit score unions consider the next information:

#1. The whole cost historical past of all credit score accounts. It has a weightage of 40%.

#2. The sort and age of credit score accounts are additionally a deciding issue, and it holds 21% in weightage.

#3. Your credit score utilization historical past can also be essential. VantageScore provides 20% weightage to this report.

#4. With 11% weightage within the total credit score rating, the entire steadiness can also be an important issue.

#5. Your latest habits of credit score account utility holds 5% weightage.

#6. And at last, the remaining 3% is roofed by the obtainable credit score information.

The Desk of VantageScore Rating Slab and Scores

In line with the VantageScore model 4.0, the followings are the credit score rankings towards their credit score scores:

| VantageScore Scale | Credit score Score | Significance |

| 781-850 | Glorious (Tremendous Prime) | Lowest threat, lowest curiosity |

| 661-780 | Good (Prime) | Aggressive charges, restrictions in sure credit score accounts |

| 601-660 | Honest (Close to Prime) | No main delinquencies, larger rates of interest |

| 300-600 | Poor/Unhealthy (Subprime) | Highest threat, huge lenders deny credit score functions |

What Is a FICO Rating?

Right this moment, about 90% of American lenders use this creditworthiness mannequin. The Honest Isaac Company got here up with the mannequin in 1989, therefore its identify FICO. FICO rating is the important element of assessing a credit score account applicant in terms of actual property mortgages.

Aside from actual property, it additionally has completely different variations of fashions to cater to different industries like bank cards, auto loans, and many others. Therefore, the FICO rating of 1 trade will differ from one other. Additional, the FICO rating ranges from 300 to 800.

The Calculation of a FICO Rating

Honest Isaac Company makes use of a proprietary credit standing calculation mannequin to indicate a credit score rating. Nonetheless, the specialists of this trade think about the next monetary information accountable:

#1. Well timed funds of all credit score account obligations maintain 35% weightage.

#2. The quantity owed is the second most important metric, and it has a weightage of 30%.

#3. FICO provides a weightage of 15% to the age of credit score when it calculates your credit score rating.

#4. It is best to have a mixture of installment and revolving credit score accounts (credit score combine), and this holds 10% weightage.

#5. The ultimate 10% of the credit score rating is dependent upon new credit score account functions. Therefore, for those who steadily apply for loans, you will notice a dip in your credit score rating.

The Desk of FICO Rating Slab and Scores

| FICO Rating Scale | Credit score Score |

| 800 to 850 | Distinctive |

| 740 to 799 | Very Good |

| 670 to 739 | Good |

| 580 to 669 | Honest |

| 300 to 579 | Poor |

Numerous Variations of FICO Scores

As a result of completely different operational fashions for the large three credit score unions of the USA: TransUnion, Experian, and Equifax, there are completely different FICO variations. Moreover, the varied kinds of FICO scores are helpful in numerous lending industries as a complete or partially. For instance:

FICO 2

FICO Rating 2 is the devoted metric to verify your creditworthiness once you apply for mortgages, bank cards, and vehicle shopping for loans. Experian publishes a number of kinds of FICO 2 like FICO Auto Rating 2, FICO Bankcard Rating 2, and FICO Rating 2 (mortgage).

FICO 3

When bank card issuers contact Experian in your credit standing, they get the FICO 3 rating card. Relying on its well being, the lender grants or denies your utility.

FICO 4

For mortgages, bank cards, and auto mortgage processing through evaluation of credit score reviews from TransUnion credit score bureau, lenders depend on FICO 4. Numerous kinds of FICO 4 are FICO Auto Rating 4, FICO Bankcard Rating 4, and FICO Rating 4.

FICO 5

For auto loans, bank cards, and mortgage credit score account decision-making Equifax publishes three completely different sorts of FICO 5 scores. These are FICO Auto Rating 5, FICO Bankcard Rating 5, and FICO Rating 5.

FICO 8

FICO 8 is frequent amongst all of the three main credit score unions. You may get specialised variations like FICO Auto Rating 8 and FICO Bankcard Rating 8 for the auto and bank card trade.

FICO 9

All three huge credit score bureaus publish FICO 9 scores of people. The FICO Rating 9 is commonplace for many lending selections. Nonetheless, FICO Auto Rating 9 is restricted to the auto sector, and FICO Bankcard Rating 9 is a devoted mannequin for the bank card sector.

The Most Used FICO Model

In line with the declarations from the Honest Isaac Company, FICO Scores 8 and 9 are probably the most generally used FICO mannequin within the USA. Many of the lending sectors, like bank cards and auto loans, require these credit standing numbers.

FICO Rating Vs. VantageScore: Variations

#1. VantageScore is a transparent indication of your credit score well being. Additionally, it helps you enhance your credit score historical past by suggesting you some ideas and methods. Alternatively, the FICO rating merely signifies a credit score rating and nothing else.

#2. VantageScore has 4 credit standing slabs whereas FICO rating has 5 slabs.

#3. VantageScore and FICO scores think about completely different monetary information and their weightage to calculate the ultimate credit score rating.

#4. You may simply qualify for a VantageScore when you’ve got any credit score account, regardless of the credit score age. Quite the opposite, for a FICO rating, you might want to have a mixture of credit score accounts like a line of credit score, loans, bank cards, and many others., which can be at the very least 6 months previous.

FICO Rating Vs. VantageScore: The Most In style One

FICO rating has been within the monetary lending system for longer than the VantageScore. Therefore, it has naturally gotten far more publicity than its competitor. Additionally, government-sponsored house mortgage securitization enterprises like Freddie Mac and Fannie Mae have solely authorised the FICO rating to be the figuring out issue when issuing retail house loans.

Now that you just’ve gone via the theoretical fundamentals of credit score rating, FICO rating, and VantageScore, discover under some on-line instruments that may enable you:

myFICO

Throughout the USA, 90% of lenders and monetary establishments use FICO scores to disburse loans, auto loans, bank cards, and mortgages. The father or mother firm goes with the identical identify FICO and has created a shopper division referred to as myFICO.

Its cell and on-line app allow you to examine numerous credit score reporting fashions like TransUnion, Equifax, Experian, 3-bureau credit score report, and FICO facet by facet. Thus, you get oversight of your private FICO rating vs. credit score rating for funds and compensation of borrowings.

It additionally helps you get better from identification theft instances, updates you on real-time credit score rating modifications, and detects identification theft instances prematurely. All of its providers can be found in numerous slabs at separate paid subscription plans.

Experian

Experian is without doubt one of the leaders in monetary information evaluation and allotting a creditworthiness rating for people, professionals, and companies.

It gives numerous providers to allow clean credit score distribution by lenders to a potential particular person or enterprise. Some notable providers are:

- Free Credit score Studies and Rating

- Private and Household-Clever Id Theft Safety

- Free Darkish Internet Scan

- A web based market for auto insurance coverage, loans, and bank cards

- FICO rating vs. credit score rating

Additionally, to assist the customers from credit score disputes and mismanagement of funds, it gives credit score assist and credit standing training.

WalletHub

WalletHub is one other on-line device for staying on high of your credit score reviews, credit score scores, credit score monitoring, and bank cards. Moreover, many of the providers on this monetary providers platform are free for people and companies.

One cool function of this device is you possibly can generate your credit score rating even when you don’t possess any bank cards. Its private pockets additionally showcases different information associated to credit score rating enhancements, WalletScore, 24/7 Credit score Monitoring, Full Credit score Studies, and plenty of extra.

Furthermore, you can too get insights on numerous bank cards earlier than making use of, particularly in case you are a brand new applicant. Lastly, it provides worth to your effort by offering a one-stop store for mortgage corporations, credit score unions, pay as you go playing cards, banking providers, actual property brokers, and many others.

CreditWise: Capital One

Whether or not you’re a enterprise, skilled, or a person who desires to watch credit score rankings without spending a dime with out hurting it will possibly strive CreditWise from Capital One. The device is on the market on-line via net browsers, Android, and iOS units.

It primarily assists you in managing and perceive the VantageScore creditworthiness report. Therefore, in FICO rating vs. credit score rating, for those who favor the VantageScore, you could enroll.

Tips on how to Restore Your Credit score Rating

A low credit score rating just isn’t good in your monetary life since it will possibly negatively have an effect on many features of your life. Chances are you’ll not discover appropriate rented lodging. Typically insurers and employers could not need to take care of you both.

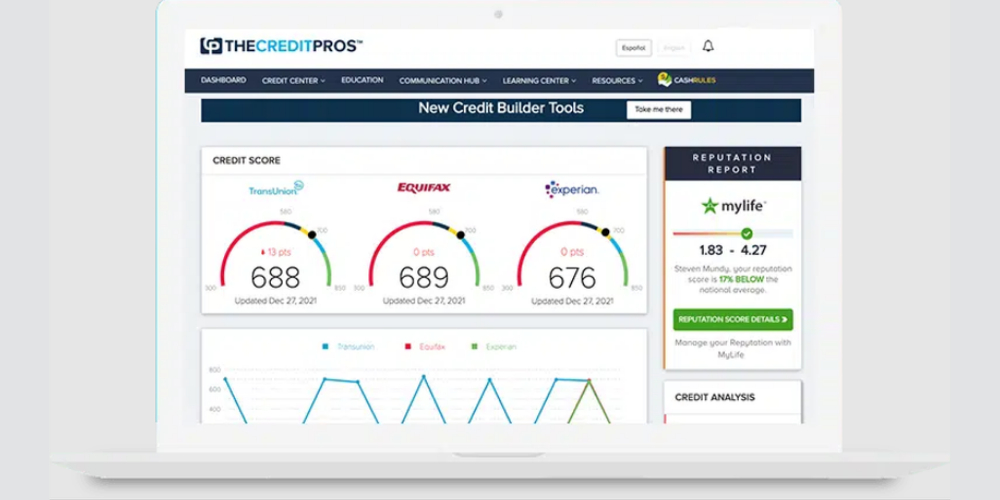

Principally, there may very well be unfavourable gadgets or machine errors that have an effect on the rating. Therefore, you might want to recruit the very best FICO, VantageScore, or Credit score Rating specialists. One such credit score restore service supplier you could strive is The Credit score Execs.

The corporate gives aggressive credit score repairing charges, monetary instruments, and expense monitoring packages that prevent from late charges and protects your credit score rating from identification theft instances.

Closing Phrases

This in-depth article on FICO rating vs. credit score rating will enable you perceive some widespread credit standing fashions that bank card, mortgage, and private mortgage lending companies use to find out your creditworthiness.

You may additionally have an interest to study that are the very best private finance Excel templates obtainable without spending a dime to handle funds the fitting means.