You’re courageous to begin and survive in a enterprise within the new regular! Let Novo enterprise banking make it easier to with all-things banking in your group to grow to be a profitable enterprise proprietor.

Digitization of companies has additionally pushed the adoption of digital banking. These on-line financial institution accounts present a variety of companies that your group wants. And, all these companies are minus the trouble of visiting an precise financial institution.

Enterprise banking companies goal micro, small, medium, startup, and enterprise-level entities. Nonetheless, selecting the best one is one other difficult enterprise. It can save you time and assets by signing up for Novo as your enterprise banking accomplice. Proceed studying to study novel issues about Novo.

Introduction to Enterprise Banking

Companies have to take care of complicated and limitless transactions. These are primarily getting paid from shoppers, paying distributors, financing belongings by means of loans, getting credit score traces, paying taxes, making deposits, getting checking accounts, and so forth. The banking system for people, popularly generally known as retail banking establishments, cannot deal with such volumes and variations of transactions.

Right here comes enterprise banking. Such financial institution accounts include all of the talked about companies above plus added advantages. In a nutshell, you adjust to native and worldwide cash administration guidelines and likewise do financial transactions together with your clients swiftly.

The Advantages of Enterprise Banking

Monetary Safety for Employees and Proprietor

For LLCs or related enterprise varieties, the employees or proprietor should not held accountable when a enterprise fails on account of market causes. If any of such occasions occur, it doesn’t imply that it’s good to pay out of your pocket for enterprise money owed. You aren’t liable once you separate your funds from enterprise banking.

No Decrease or Higher Restrict of Account Steadiness

A retail financial savings account comes with higher and decrease limits for funds. There aren’t any such restrictions on most enterprise banking accounts as a result of your enterprise must deal with bulk transactions of cash and belongings.

Organized Expense Dealing with

Expense reporting and monitoring have grow to be tremendous straightforward with enterprise banking. Such an account additionally lets you keep away from overspending and dropping margin.

Complying With Monetary Laws

Since enterprise banking corporations handle varied compliance practices, you robotically adjust to the identical legal guidelines once you hold an account with such establishments.

Personalized Providers

You may go for the companies that you really want and discard these your enterprise doesn’t want but.

Personalised Charges

Since you possibly can customise banking companies, you may get a greater deal for the yearly charges in addition to transaction-linked service fees.

Worldwide Travels

Enterprise banking playing cards include higher foreign exchange conversion charges, airport lounge entry perks, and extra.

The Emergence of Enterprise Banking Instruments

Since it’s good to handle international enterprise transactions 24 by 7 for one year, you want the next enterprise banking instruments:

- Checking accounts

- Worldwide and home letters of credit score (LCs)

- On-line and cell banking channels

- On-line and point-of-sale cost assortment platforms

- Digital verify deposit system

- Managing money for payroll, funds, and many others.

- Cellular verify deposit system

- Video teller machine (VTM) service

- Prepared Reserve with an auto sweep out and in

- FDIC insurance coverage

- Devoted credit score line and mortgage processing channels

A number of banking firms understood the above wants of a company and began providing such companies packaged into one or just a few accounts. For instance, Novo enterprise banking gives many of the above companies by means of one enterprise checking or financial savings account so to deal with working your enterprise, not queue up in entrance of banks.

What Is Novo Enterprise Banking?

Novo is a fintech service supplier for Middlesex Federal Financial savings, F.A, and gives Novo enterprise banking. It’s a model identify, whereas the underlying banking companies come from Middlesex Federal Financial savings.

Novo will not be an unbiased financial institution and cannot settle for financial deposits or supply its banking merchandise. Moreover, solely US residents or foreigners proudly owning a enterprise working within the US can open a enterprise banking account at Middlesex Federal Financial savings, facilitated by Novo.

Although it gives enterprise monetary accounts to foreigners, it’s possible you’ll not open an account with Novo in case you are from a USA-sanctioned nation.

It primarily gives a full-service enterprise checking account with varied instruments to handle all types of financial transactions taking place inside a enterprise.

Obtain: Novo for Android | iOS

How Does Novo Assist You to Handle Enterprise Accounts?

Novo enterprise banking is the state-of-the-art digital platform for contemporary banking. Being a enterprise proprietor, you possibly can apply for a enterprise checking account on-line in a couple of minutes. Due to this fact, you possibly can make investments the time you unlock from not standing in line into enterprise progress.

Its on-line and cell platform comes with all the fashionable and digital banking instruments it’s good to run a enterprise globally and regionally. Additionally, you get absolute enterprise freedom with out violating any native or worldwide monetary laws.

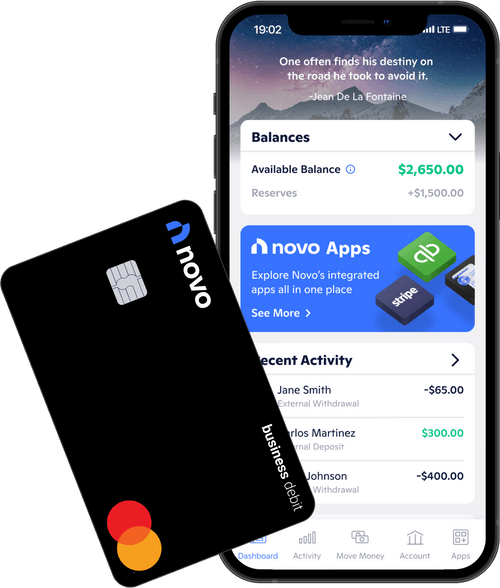

Moreover, the Novo app is powerful and elaborate sufficient to deal with account linking, processing ACH transactions, paying payments, depositing checks, and extra. And never simply the cell app! You get a enterprise debit card with many perks. One such perk is free ATM withdrawal in distinguished nations with none ATM transaction charges.

These are simply normal Novo enterprise banking highlights to indulge you in varied useful companies of Novo. You’ll study extra about its options and business utilization beneath.

Novo Enterprise Banking Options That Make It an Ideally suited Alternative

The followings are essentially the most sought-after options that professional businesspersons search from a profitable enterprise banking channel like Novo:

Absolutely Cellular Novo Enterprise Banking

Handle the financials of your group from a smartphone. The Novo cell app helps Novo Reserves, cost platform collections, spending visualizations, transaction historical past, and many others.

On-line Account Opening

You may apply for a enterprise checking account through Novo nearly on a pc. You don’t want to go to any Middlesex Federal Financial savings department. Therefore, you save on transport prices, nonproductive schedules, and many others.

Trouble-Free KYC

Novo additionally processes the KYC identification verification on-line vi, gathering digital paperwork, eSignatures, and many others. No have to print out paperwork and submit them to your financial institution department.

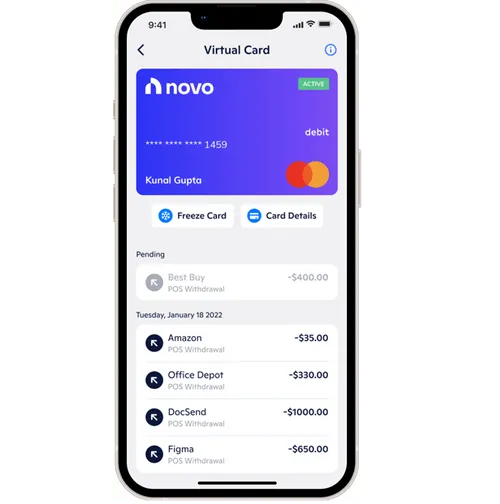

Novo Digital Card

Novo’s account opening characteristic is so streamlined that your account could also be up and working in a couple of minutes, supplied that the paperwork you present are legitimate. As soon as your account is lively, you instantly get a hyperlink to entry your digital enterprise banking card.

Thus, you possibly can hold your enterprise funds updated on-line with out ready for a brand new bodily card from the financial institution.

Invoices

The Invoices operate of Novo saves you from shopping for an invoicing device. As a substitute, create skilled and customised invoices on Novo. Additionally, ship them to purchasers, schedule invoices, route purchasers to the cost interface, and extra utilizing this characteristic.

Novo Reserves

Novo Reserves is a sturdy enterprise and cash administration performance. For instance, you possibly can allocate reserve funds for as much as 10 Reserve heads and use these funds to develop your enterprise or save your enterprise from any corrective actions out there.

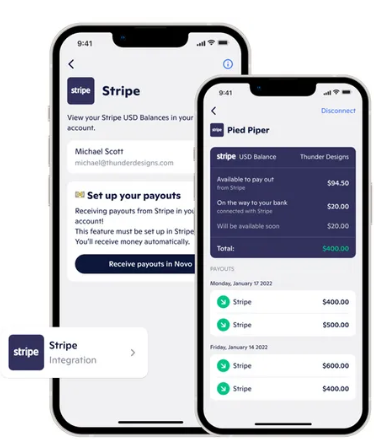

Stripe Funds

Novo is a Stripe Verified Companion. It means you get precedence and reasonably priced companies from Stripe. For instance, Stripe funds will arrive in your Novo account 95% quicker than different platforms.

Novo Enhance

Novo Enhance processes your on-line transactions quicker so to get your cash immediately for payroll, taxes, vendor funds, and many others. At present, the options can be found for Stripe integration in Novo.

Straightforward Cash Transfers

Novo additionally gives you restricted free cash transfers with none higher or decrease restrict. You may simply deliver cash to Novo’s enterprise banking account from current company accounts. Moreover, you possibly can ship cash to different accounts utilizing a cell or pc.

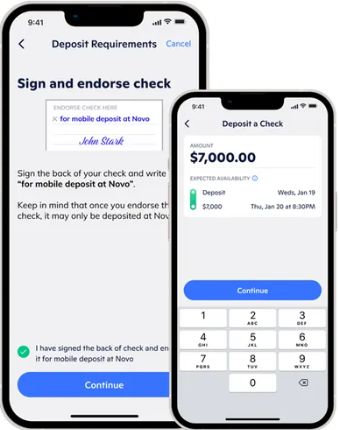

Verify Deposits

Novo can also be in style for its hassle-free verify deposit processing. You may deposit a verify by exercising the followings:

Scanning a verify and sending that for clearance

Take {a photograph} of the verify utilizing a cellphone and deposit it on-line

Furthermore, Novo permits limitless verify deposits day by day. It additionally doesn’t cost any verify deposit charge from you.

Straightforward Funds

Novo enterprise banking account’s cost options embody the followings:

- Free and limitless transactions within the USA

- Paper verify deposits and ACH are free from charges

- Easy accessibility to Clever for worldwide funds

Worldwide Journey Transactions

You should use the EMV-chip Grasp debit card throughout enterprise travels in overseas places. Novo refunds all of the ATM charges that you simply incur throughout overseas journey.

Card Funds

For those who do not need entry to any bank card however have to make an pressing cost in the direction of Google Adverts, you need to use the Novo debit card on Google Pay. Google’s opponents like Samsung and Apple additionally settle for this debit card.

Novo Instruments for Companies

#1. Apps From Novo

It brings you automated workflow options through Novo Apps. For instance, some apps allow you to join a number of cost interfaces. For those who acquire funds on Stripe, Shopify, PayPal, and many others., you possibly can view the transactions in your Novo account. Different app functionalities are billing, budgeting, cash transfers, and many others.

#2. Novo Perks

It can save you as much as $4,000 on enterprise apps, instruments, and services once you join a Novo enterprise banking account. For instance:

- $500 Google Adverts credit score on spending $500

- $150 credit for Snap Chat Adverts

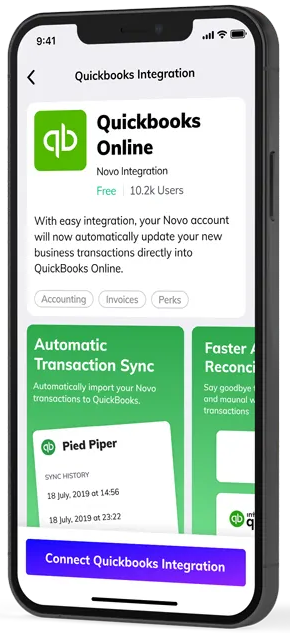

- QuickBooks on-line low cost of 30% for the primary 6 months

#3. Novo Incorporate

You will get assist from Novo and LegalZoom to kind a company out of your small or medium enterprise in authorized methods. Such actions are generally known as incorporation and are extremely essential for enterprise progress. You can begin an S Corp, LLC, Non-Revenue, and C Corp on Novo.

#4. Novo Integrations

Novo integrations empower you to navigate round totally different third-party enterprise apps with none confusion. Largely, you possibly can entry app information from Stripe, QuickBooks, Shopify, Xero, Sq., and Clever straight on a Novo banking account utilizing integration companies.

#5. Novo Useful resource Heart

The Novo useful resource heart provides you free entry to premium coaching and articles on enterprise. You may entry a whole lot of content material underneath high headers like SMB Insider, Firm Information, Firm Tradition & Administration, Enterprise 101, and Banking 101.

You may undergo these assets to study the enterprise from the within out whereas managing your small enterprise, gigs, and many others.

Novo for Industries

Novo’s monetary know-how is for any enterprise that operates within the USA. For instance, you may get a enterprise checking account from Middlesex Federal Financial savings by means of Novo for the next industries and enterprise domains:

- Well being & magnificence like barbers, nail technicians, coaches, therapeutic massage therapists, and many others.

- eCommerce & retail like on-line outlets, retail, resellers, dropshippers, and many others.

- Meals & Beverage, as an example, catering companies, eating places, bakeries, espresso outlets, and many others.

- Every kind of small companies like truckers, Airbnb hosts, Vrbo hosts, actual property, and so forth.

- Skilled companies suppliers like freelancers, gig staff, digital entrepreneurs, and many others.

All of the above-mentioned industries and enterprise niches can use varied Novo instruments and functionalities to arrange each penny and its transaction routes. In any case, you possibly can develop your enterprise solely when you understand the place your cash is and the way you might be spending it.

Novo Options

Discover beneath some options to Novo for simpler valuation of Novo’s companies with just a few opponents:

Relay Monetary

Relay Monetary is a well-liked enterprise checking account supplier amongst US LLCs, US firms, and enterprise house owners from many overseas nations so long as their enterprise has a unit within the US. It gives Mastercard Zero Legal responsibility Safety, FDIC insurance coverage, app integrations, and many others.

Clever Worldwide Enterprise Account

Clever gives painless enterprise banking for any ventures that have to pay employees, settle for funds from purchasers, course of taxes, and extra. Moreover, it gives complicated and superior enterprise monetary accounts with none month-to-month charges and hidden fees. Furthermore, its enterprise banking charges are truthful and it gives higher foreign exchange conversion charges.

Revolut

Revolut is one more enterprise banking account that gives normal company companies like playing cards, groups, rewards, multi-currency accounts, international cash transfers, expense monitoring, cost channels, and many others. It gives a free account to check out some fundamental options.

Remaining Phrases

To date, you’ve gone by means of the options and use circumstances of the Novo enterprise banking companies. Moreover, you’ve found some Novo options to attract a comparability.

After evaluating all of the options, we propose Novo enterprise banking for companies of all sizes. If you’re a bit skeptical, you possibly can verify with the Novo group for a extra clear demonstration. If the companies are state-of-the-art and reasonably priced, you may make a deal!

You may additionally be curious about these companies checking accounts.