QuickBooks and FreshBooks reign supreme amongst software program for small enterprise accounting and are frequently ranked prime.

Each accounting instruments have a powerful observe document, supply comparable primary options with a couple of key variations, and are constructed for particular enterprise functions.

Each new enterprise proprietor, accounting agency employee, or freelancer is aware of the problem of operating a small enterprise. Buying uncooked supplies monitoring funds and enterprise bills, or checking the influx and outflow of cash, is nothing wanting a critical every day wrestle that takes immense effort.

The higher method is to make use of accounting administration software program that helps handle all the things from bill templates to monitoring every day bills and earnings.

Moreover making the complete course of environment friendly and permitting you the time to work on different duties, utilizing accounting software program this present day lifts the heavy burden off your shoulders.

Whereas most individuals agree that having accounting software program is a must have for small enterprise house owners and freelancers along with different challenge administration instruments, selecting between completely different accounting software program turns into a tedious and complicated process.

If that describes you, we’ll allow you to evaluate two main accounting software program: QuickBooks and FreshBooks, that will help you decide the best choice on your challenge.

What’s Quickbooks?

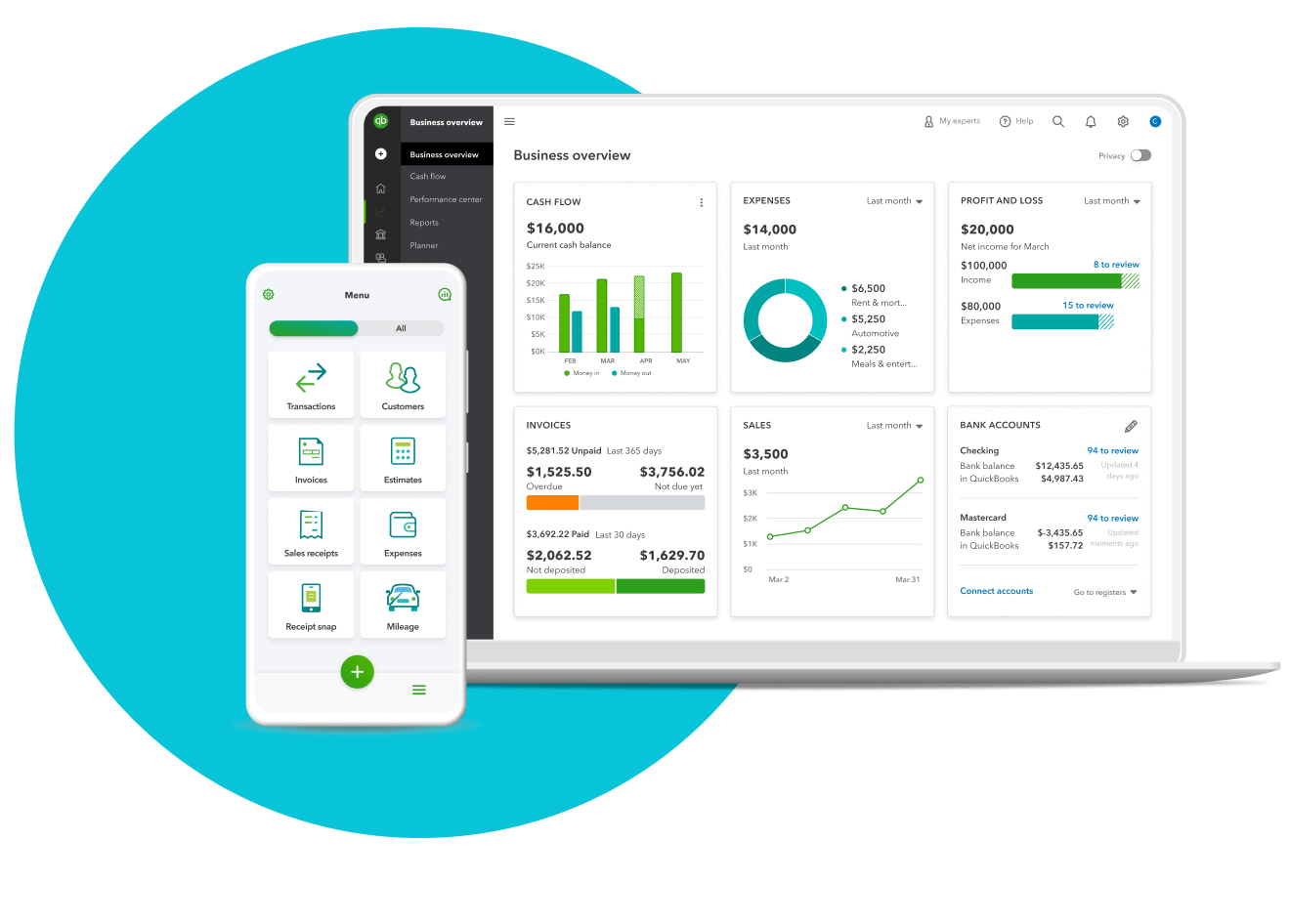

QuickBooks is a well-liked small enterprise accounting software program that may handle a company anyplace. The answer provides an revolutionary and user-friendly suite of accounting instruments providing firms a transparent view of their earnings while not having handbook imputing.

Quickbooks harmonizes with accounts, categorizes transactions spontaneously, and provides accounting groups a seamless approach to handle bills, manage books, observe stock, ship invoices, and run payrolls.

Firms that use QuickBooks can simply customise its numerous instruments like cloud accounting, time monitoring, and fee processing for sooner funds to go well with their specific wants. The versatile software program might be accessed and managed from computer systems, laptops, tablets, or smartphones.

Key Options of Quickbooks

#1. Collaboration

Accountants, bookkeepers, and different licensed staff of firms utilizing QuickBooks can log in concurrently and enter information straight on-line and observe all modifications by way of an in depth exercise log.

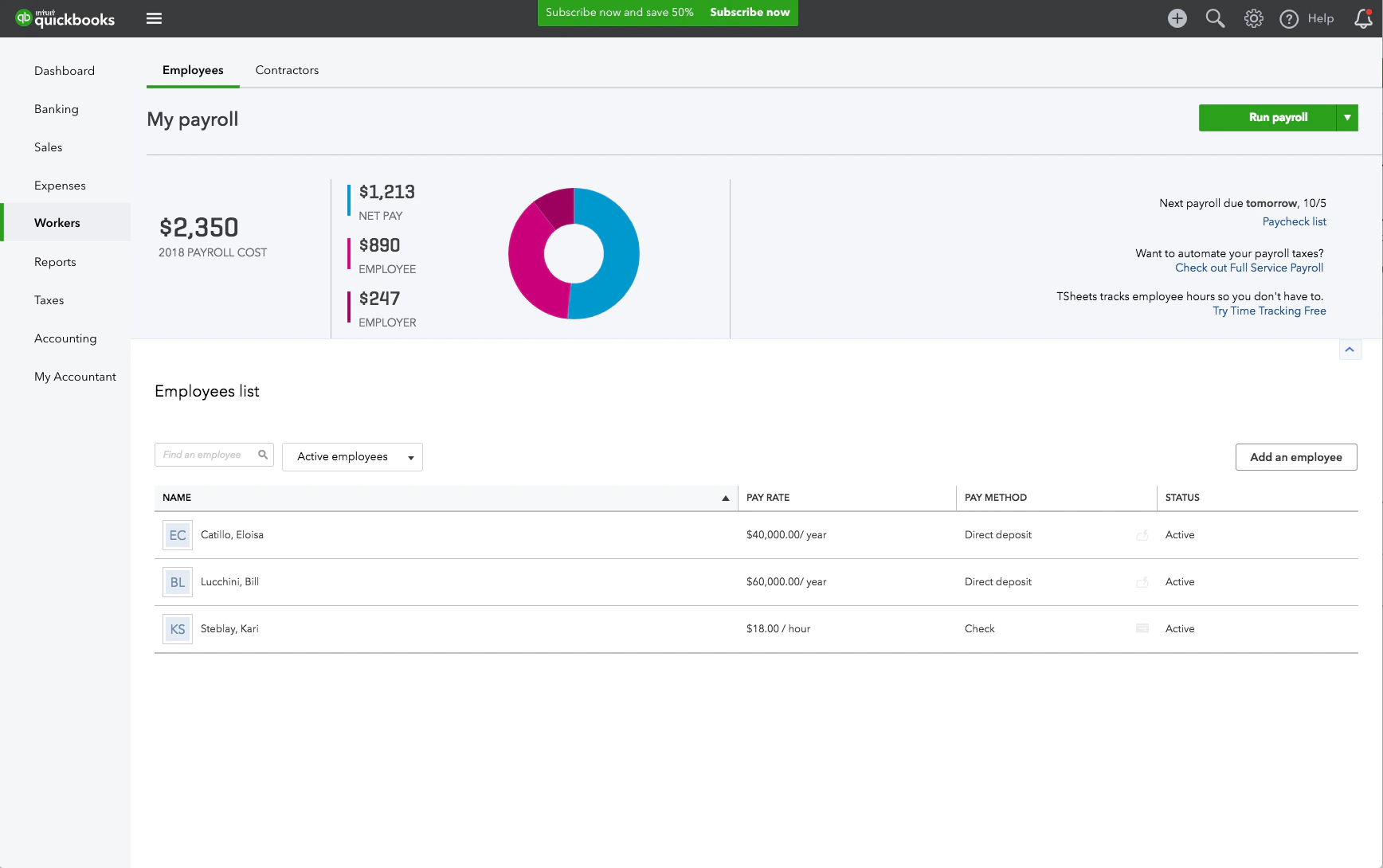

#2. Payroll Tax Administration

QuickBooks mechanically calculates taxes associated to each paycheck apart from paying and updating payroll taxes. The software program additionally supplies tax penalty safety and may remit as much as $25,000 if the group is penalized.

#3. Tracks Enterprise Bills

The QuickBooks cell App allows taking and saving footage of receipts which it may well match to current transactions.

QuickBooks can mechanically import, observe and categorize bills when linked to a person’s checking account, bank card, or PayPal account. This characteristic helps customers run reviews exhibiting their minute expenditures.

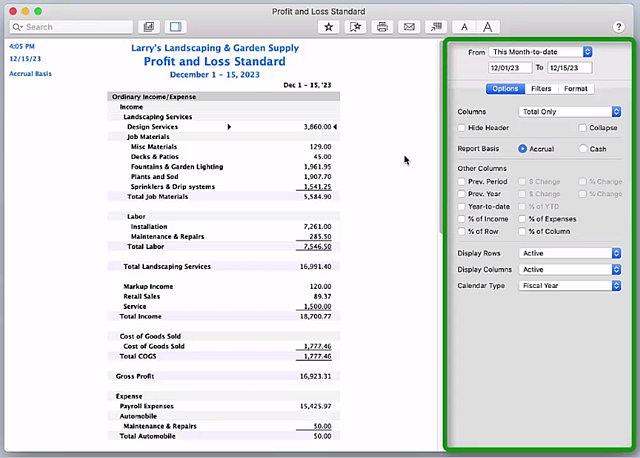

#4. Experiences

Customers can use QuickBooks to create and share professionally summarized monetary and enterprise information with companions, enabling accounting groups to customise reviews to precedence info and conserving accountants up to date in real-time by way of e mail.

Some essential insights customers can unlock from the dashboard embrace insights concerning the enterprise, steadiness sheets and monetary statements, and custom-built reviews and gross sales tendencies.

What’s FreshBooks?

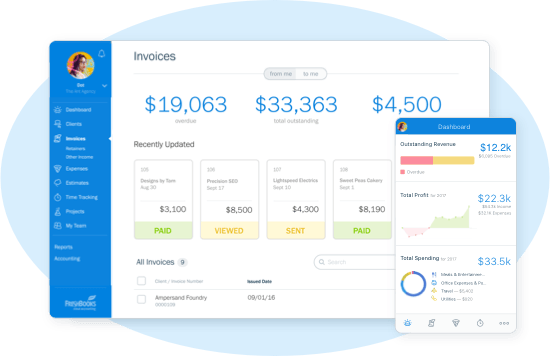

FreshBooks is a cloud-based accounting answer for freelancers and small and medium-sized companies. The simple-to-use accounting software program provides an intuitive answer for operating accounting reviews, organizing bills, creating invoices, and getting paid.

Customers can entry FreshBooks by way of an internet browser from any laptop or select the versatile FreshBooks App to work anyplace utilizing iPhone, iPad, or Android units whereas they’re on the transfer. All information is securely saved within the cloud.

FreshBooks’ customers can spend much less time doing paperwork because it facilitates simple invoicing and accepts on-line funds. It’s also possible to observe hours a person has labored and switch these hours into an bill for proper billing for work performed.

FreshBooks mechanically tracks all of your transactions when linked to a checking account. On the similar time, it additionally data and categorizes transactions on the similar place, that means that tax time is not a problem.

Key Options of Freshbooks

#1. Accounting, Invoicing, and Funds

FreshBooks is a hassle-free, double-entry accounting software that ensures accuracy and compliance, serving to customers establish and isolate income gadgets and associated bills to find out earnings and losses precisely. The software program’s computerized checks and balances characteristic permits one to ensure debit and credit score quantities.

FreshBooks customers may give their accountants unique entry to monetary and reporting info to allow them to help their companies higher apart from facilitating computerized financial institution reconciliation, credit score administration, and accounts payable.

The quick invoicing characteristic allows customers to automate fee reminders, request partial deposits, shopper retainers, and computerized fee reminders.

#2. Time and Expense Monitoring

FreshBooks integrates a built-in time tracker and a workforce timesheet that freelancers can use to log in and mechanically enter their time into an bill.

Customers also can log in to an expense tracker for higher monitoring of money movement after they hyperlink the software program with their financial institution accounts, apart from with the ability to categorize bills or mark them as billable when monitoring challenge bills for budgeting.

#3. Centralized Initiatives and Experiences

Organizations utilizing FreshBooks can simply collaborate with their enterprise companions and contractors utilizing the centralized file storage that gives built-in permission that secures entry.

The software program’s profitability instruments aptly show breakdowns, summaries, and detailed reviews, apart from offering ready-made proposals and estimates, monetary statements, shopper administration, iOS and Android Apps, and computerized mileage trackers.

Quickbooks vs. Freshbooks

#1. Invoicing

FreshBooks’ customizable bill designs characteristic a click-to-pay button to facilitate stress-free fee for on-line invoices, which may retrieve information straight from the timekeeping characteristic. Different automated capabilities embrace recurring invoices for billable hours and follow-up emails for excellent funds. Recipients pays their invoices immediately by way of Apple Pay and bank cards of ACH.

QuickBooks tracks billable hours by integrating exterior time-tracking apps akin to TSheets and Google Calendar and contains them within the invoices. The software program’s bill builder contains customization options akin to altering colours or brand addition which customers can use earlier than sending out invoices. The fee choices embrace a click-to-pay button that permits prospects to decide on between paying with Apple Pay, bank card, or ACH fee, apart from sending reminders for overdue and recurring platforms.

#2. Time-Monitoring

FreshBooks’ in-built time tracker is right for case-based and project-based companies the place employees observe billable hours and associated bills. Customers can view the hours on the dashboard, hold observe of particular person staff, and import information into the accounting system in real-time.

QuickBooks has an add-on referred to as QuickBooks Time at an additional price for customers thinking about monitoring time labored by full-time or part-time staff. Firms that don’t pay for the add-on should enter payroll as an expense and categorize the service provided. That sounds cumbersome approach to observe an worker or freelancer’s time.

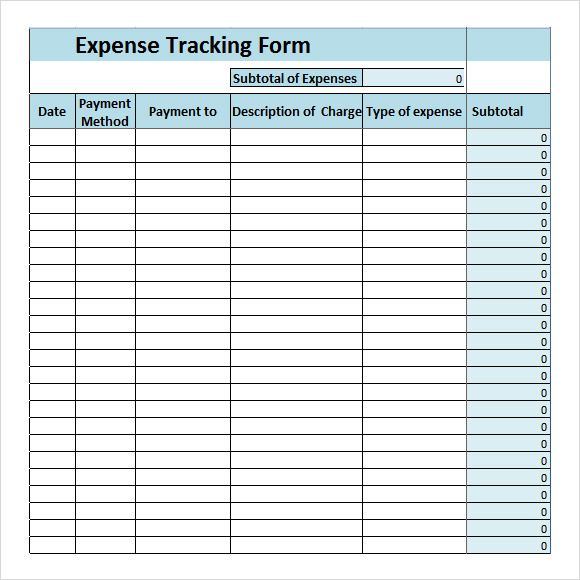

#3. Expense Monitoring

QuickBooks provides debit and bank card help, conserving customers usually knowledgeable on revenue margins inside the month-to-month accounting cycle. The one draw back right here is that it requires some handbook entry since QuickBooks On-line reveals solely line gadgets and less nuanced breakdowns. Customers can replace month-to-month repayments utilizing the QuickBooks cell App to take footage and add receipts.

FreshBooks is designed explicitly for invoicing and fee assortment, that means customers should combine an exterior accounting system. Nonetheless, the software program supplies distinctive expense monitoring options akin to challenge time monitoring, receipt monitoring, and gross sales tax administration, which come in useful for novices within the enterprise.

#4. Ease of use

QuickBooks and FreshBooks current easy-to-use graph-filled intuitive dashboards with vertical sidebars by means of which customers can entry completely different options, together with these with little or no accounting information. Nonetheless, QuickBooks seems simpler to arrange in comparison with FreshBooks. Customers can simply document and modify journal entries in FreshBooks, in addition to start balances and handle chart accounts.

FreshBooks facilitates simpler information entry; nonetheless, customers can’t shut a previous interval transaction which is critical to stop unsolicited modifications to accounting information. Whereas it’s doable to enter starting balances and modify journal entries on FreshBooks, you could be an account person registered utilizing a unique e mail handle to perform that.

#5. Tax Calculations

Intuit, the creator of the well-known TurboTax and QuickBooks on-line, has included loads of supportive tax options within the software program. The software is designed to generate as many end-of-year tax types because the variety of staff a person has. Moreover, enterprise house owners can manage expense and revenue taxes by class to compute the quantity they owe quarterly taxes apart from monitoring gross sales tax and mechanically including payable taxes on invoices.

FreshBooks provides a tax planning characteristic, nevertheless it’s much less versatile than the one offered by its important competitor, which may make tax planning a bit difficult for freelancers and non-accountants. FreshBooks additionally provides some tax help, nevertheless it can’t observe bills by way of receipt scanning; as a substitute, customers can solely observe taxes by linking their financial institution accounts. Whereas that ought to be high-quality, a busy workplace’s lack of an in-built receipt scanner might be irritating.

#6. Accounting

FreshBooks boasts of a double-entry accounting characteristic that helps to trace income gadgets towards bills. In consequence, customers have a tough thought of their earnings and losses effectively prematurely. The characteristic additionally ensures that debit and credit score quantities are at par and immediately pinpoints errors to keep away from tax season challenges.

FreshBooks customers can import and categorize monetary transactions utilizing completely different classes for transfers, fairness, or refunds, apart from summarizing reviews that may be exported to Excel. Customers also can simply add their accountant to the FreshBooks account to allow them to have unique entry.

QuickBooks is designed to trace all bills by sorting transactions and separating them into tax classes. The software program additionally hyperlinks pictures of receipts to their respective transactions and makes use of uncooked information to generate several types of reviews. The QuickBooks cell app makes use of smartphone GPS methods to mechanically observe the gap a person travels in miles and creates a report that precisely logs enterprise journey deductions.

#7. Reporting and Dashboards

Each accounting software program supplies completely different sorts of reviews, with FreshBooks producing particular reviews on revenue and loss, shopper accounts, gross sales tax summaries, bills, and funds collected. The software’s dashboard additionally comprises probably the most relevant charts and graphs overlaying month-to-month recurring income, excellent income, income streams, whole revenue, spending, and any unbilled time.

The QuickBooks dashboard, alternatively, has a Experiences Middle on its navigation menu that offers customers a fast approach to find the usual pre-set report templates and the flexibility to customise their very own. A “administration reviews” part allows customers to construct skilled reviews with cowl pages, preliminary pages, tables of contents, and endnotes.

Examples of reviews included within the pre-set templates embrace steadiness sheets, gross sales tax reviews, audit logs, money movement statements, open invoices, revenue and loss, funds overviews, and buyer reviews compiled by class, buyer, month, and year-to-date.

#8. Pricing

Each QuickBooks and FreshBooks supply subscription-based plans, however relating to scalability, the previous supplies a greater value schedule than the latter. With QuickBooks, you’ll be able to hyperlink your accountant and develop into a member of a 5+ million on-line group.

As for FreshBooks, it doesn’t supply financial institution reconciliation for customers who choose the Lite plan, and the variety of customers nonetheless must be larger. Most significantly, take be aware that scaling is changing into more and more costly.

QuickBooks Pricing

- Easy Begin: 1 person, $25 per 30 days, 2 accounting companies

- Necessities: 3 customers, $50 per 30 days, 2 accounting companies

- Plus: 5 customers, $80 per 30 days, 2 accounting companies

- Superior: 25 customers, $180 per 30 days, 3 accounting companies

FreshBooks Pricing

- Lite: $180 yearly or $15 month-to-month

- Plus: $300 yearly or $25 month-to-month

- Premium: $600 yearly or $50 month-to-month

- Choose: Customized pricing

All of the FreshBooks plans besides Choose embrace a single person; customers pay $10 for any further workforce member.

#9. Integration Help/Integrations

There are a minimum of 400 native integrations included in QuickBooks. They embrace enterprise banking, fee software program, e-commerce, CRM, and several other different classes that ship management and visibility over customers’ monetary information and gross sales processes. Different add-ins embrace PayPal and ReceiptBank, which hold transactions updated.

FreshBooks integrates over 100 integrations focusing on small enterprise house owners and freelancers; they facilitate connecting the app to tax submitting instruments and human sources to the payroll-tax-invoicing circle. Integrations like Squarespace or Zapier assist customers observe funds apart from processing and organizing tens of different methods.

#10. Payroll

QuickBooks provides a full-service payroll plan with limitless payroll runs and end-of-year types. Different options embrace auto-calculated taxes, a web-based portal that lets staff view their tax information and pay stubs, and help for garnishments and deductions apart from downloadable historic information reviews. Customers also can entry a premium plan that helps a same-day direct deposit and worker’s firm administration and Human Useful resource help middle.

FreshBooks helps exterior built-in worker payrolls because it doesn’t have its native payroll characteristic. The software program helps Gusto, charging between $6 and $12 per person per 30 days and an introductory $39 month-to-month price. It additionally helps the Canadian-based PaymentEvolution payroll service at a restricted free tier or a $22 per 30 days tier.

#11. Buyer Help

QuickBooks runs on-line buyer help, that means you should be logged in to get entry. There’s additionally an in-built information base the place customers can ask questions and analysis subjects, apart from a sturdy group discussion board the place they’ll discover solutions.

FreshBooks’ customer support operates a stay chat choice alongside phone buyer help for 12 hours, 5 days per week. The corporate’s web site runs a searchable assist middle that addresses the commonest customer support subjects.

Quickbooks vs. Freshbooks: Variations Abstract

| Options | QuickBooks | FreshBooks |

| Overview | Based in 1983 | Based in 2003 |

| Goal Markets | Greatest for firms that promote merchandise | Greatest for service-based companies, freelancers, and solopreneurs |

| Key Options | Creates custom-made invoices with individualized logos and fields earlier than producing them on the go along with the cell app | Straightforward-to-use double-entry accounting instruments assure accuracy and compliance and make it easy to organize monetary reviews |

| Pricing | Easy Begin: $25/month Necessities: $50/month Plus: $80/month Superior: $180/month | Lite: $15/month or $180 yearly Plus: $25 month-to-month or $300 yearly Premium: $50 month-to-month or $600 yearly |

| Help | Phone, e mail, or messaging featured articles in-product assist product coaching choices searchable information base person group. | Phone and e mail help in-product assist In-product messaging FAQs searchable information base. |

| Ease of Use | Straightforward setup course of that lets customers dive straight in. Gives fundamentals and particulars added as you proceed. | A well-presented welcome web page that shows setup progress, with a vertical menu bar to the left of the display screen. |

Creator’s Word

When to Select Quickbooks

QuickBooks is right for enterprise folks promoting merchandise and managing stock as its stock administration characteristic allows monitoring every day gross sales of products from completely different channels, together with Shopify and PayPal. Its complete performance that integrates different Intuit merchandise as QuickBooks point-of-sale grows permits it to develop together with a person’s enterprise.

Because the extra widespread answer, QuickBooks can be widespread with accountants and enterprise house owners who need to align with their accountants, because it effectively manages integrations, financial institution feeds, and tax compliance. Select QuickBooks in the event you want reasonably priced accounting software program that’s designed to scale together with your small business.

When to Select Freshbooks

FreshBooks is widespread with solopreneurs, freelancers, and small enterprise house owners on the lookout for top-of-the-range accounting software program with out specializing in accountants.

It has time monitoring and billing functionalities, challenge administration, invoicing, and third-party integrations to widespread fee instruments like Stripe, which are perfect for small companies or newbies.

FreshBooks’ hassle-free performance is designed for basic audiences and is, subsequently, simple to arrange and administer. It additionally allows quick and simple integrations with small widespread enterprise instruments.

Subsequent, you’ll be able to take a look at payroll software program for startups to medium companies.