Do you discover managing payroll essentially the most difficult a part of your rising enterprise? Look no additional and check out the sensible worker fee and tax processing system Zoho Payroll.

As a result of monitoring funds, advantages, raises, and tax withholdings are complicated duties, firms of all sizes use software program to deal with all of those duties with one central instrument. One such instrument is often generally known as the payroll processing software.

Nevertheless, firms report that almost all of those payroll apps are overly sophisticated. Generally firms want a group of devoted accountants and HR managers to function the instrument.

However payroll does not should be so sophisticated. It’s a non-productive operation for any enterprise, however requires the utmost consideration from the enterprise proprietor, board members, and Chief Monetary Officer (CFO).

How a couple of actually easy app that may serve a single payroll clerk and serve hundreds of staff? Learn how the Zoho Payroll app overcomes this problem as we overview this progressive finance instrument from Zoho.

What’s Zoho Payroll?

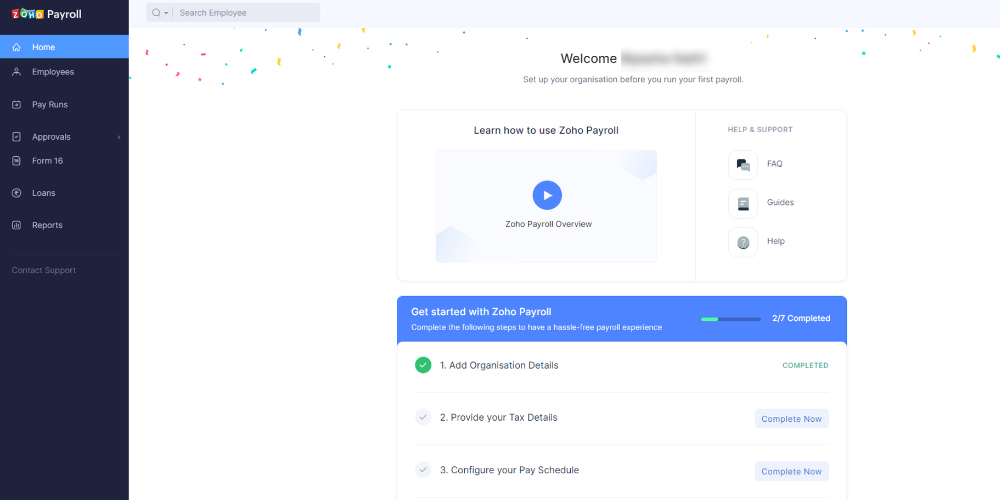

Zoho Payroll is a cloud payroll processing app. The net app is constructed into the Zoho Books account processing platform. Zoho designed this worker fee and tax planning app with US tax and employment legal guidelines in thoughts. Due to this fact, it allows simpler payroll processing by automated actions with out ending up in authorized waters.

The instrument gives computerized payroll calculations, producing pay slips for workers and in addition pays employees on time to maintain them engaged. It additionally comes with a authorized compliance module that helps your small business adjust to federal legal guidelines. To not point out the wage restructuring to calculate a number of wage plans for various staff.

As well as, it offers your staff entry to a self-service portal to obtain kinds and pay slips or add funding returns for tax-saving functions. The self-service platform helps you relieve pointless burdens on payroll, to allow them to deal with the work that issues.

It effortlessly integrates HRMS functionalities utilizing the Zoho Folks app. It additionally synchronizes Zoho Books accounting processes with Zoho Payroll. This lets you onboard staff quicker and pay them quicker.

Zoho Payroll is appropriate for startups, small companies, medium enterprises, and even giant firms. As of now, the instrument contains federal tax and employment laws from the next states: California, New York, Washington, Tennessee, North Carolina, Texas, Florida, Illinois, and Kansas. Nevertheless, you’ll be able to request early entry for different states as Zoho is working to incorporate extra areas.

Zoho Payroll Options

#1. Worker Administration

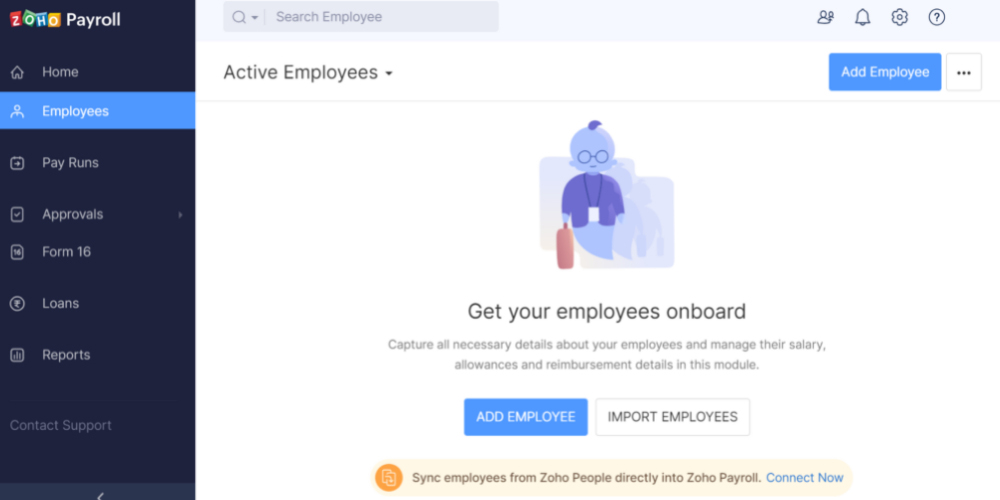

Managing staff on an HR system and processing their payroll from an accounting instrument does not appear logical. That is why Zoho has applied an worker administration module proper in your favourite Zoho Payroll app.

The performance supplies all the mandatory instruments resembling employees onboarding, paperless paperwork and worker exit administration. As well as, you’ll be able to import worker historic payroll knowledge and begin from there, even in case you are already engaged on payroll for the present fiscal 12 months.

#2. Payroll processing

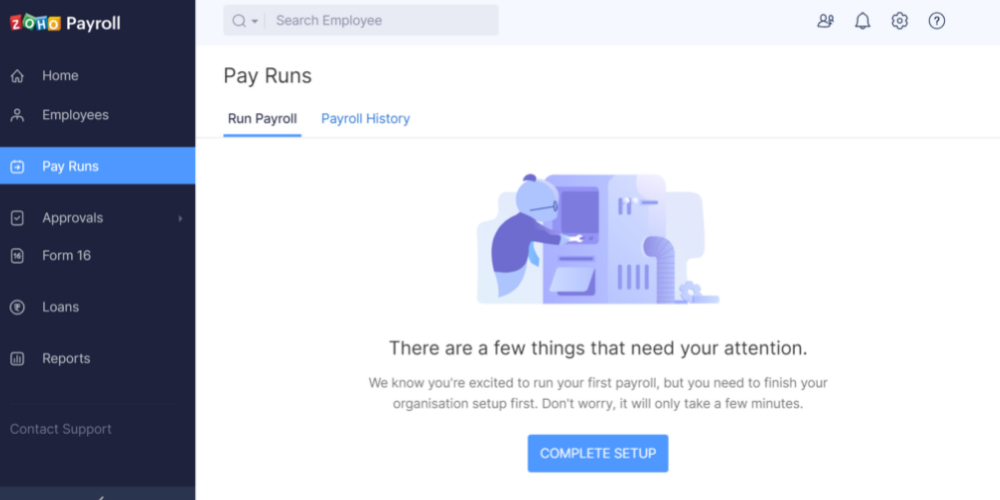

Zoho Payroll comes with an intuitive payroll processing module that makes payroll administration a breeze. The minimal wage employees can put together the corporate wage runs, authorize the wage entry and full the wage runs easily.

Payroll comes with a variety of sub-features resembling gross-to-net calculation, overview of permitted payroll, schedule payday (weekly/fortnightly/month-to-month), and on-line fee on to financial institution accounts.

Do you may have each salaried staff and freelancers on an hourly foundation? No downside in processing their funds as per their contracts because the instrument gives fee sorts and price options. Furthermore, bonus funds are made straightforward with the app because it robotically calculates advantages and tax deductions.

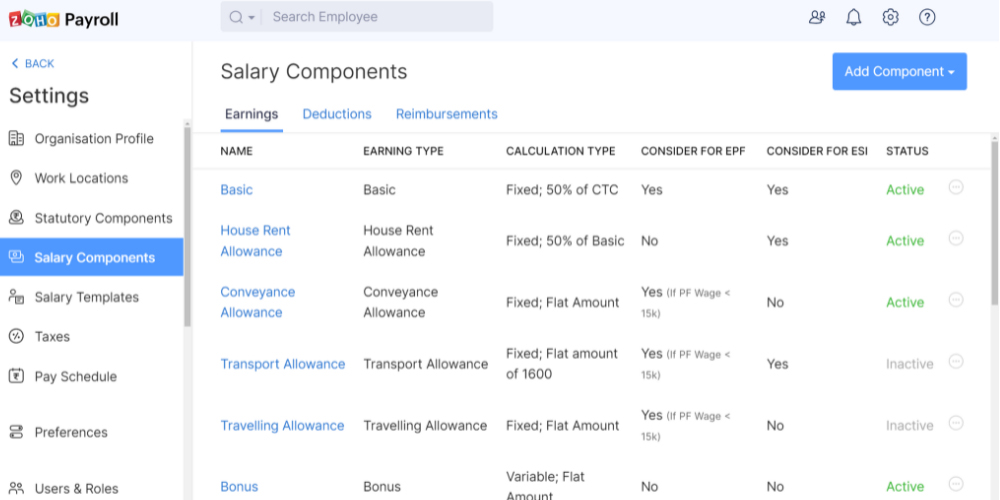

#3. Wage advantages and accounting

The payroll and accounting module permits you to embody medical health insurance, retirement advantages, and taxable advantages in an worker compensation bundle. The Zoho Payroll library gives varied advantages packages, from 401(ok) retirement plans to medical health insurance plans. You simply have to pick out the specified elements from an intensive record.

It’s also possible to schedule paid day without work, sick depart, and vacation insurance policies when you use the built-in instruments of this sensible payroll app. As well as, you too can enable staff with extra depart steadiness to money of their PTOs once they depart the corporate.

#4. Taxes and kinds

No want to go looking the Web for clarifications of tax guidelines or payroll kinds. Zoho Payroll’s Taxes and Varieties module has all of the methods compliant with the supported US states. All it’s worthwhile to do is choose the suitable state and federal tax to finish the submitting course of.

For instance, select Type 944 to create an computerized report of your organization’s annual tax liabilities for federal revenue taxes withheld, Social Safety, and Medicare. Equally, choose Type 941 to retrieve the quarterly assertion for the tax returns of whole tax deposits, Social Safety, and withholding taxes on staff’ wages.

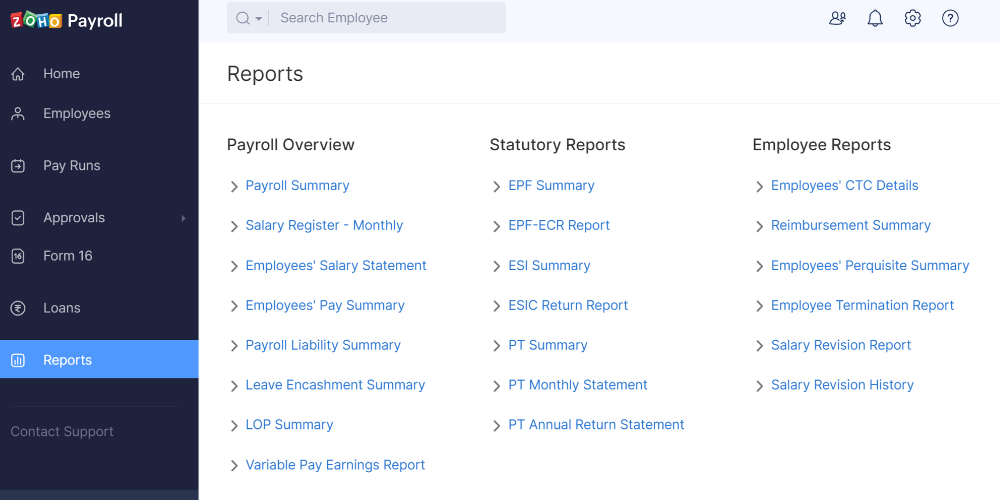

#5. Wage statistics

Wage knowledge evaluation is a crucial report that helps you optimize your small business and scale back pointless bills. You will get such knowledge insights from Zoho Payroll due to the Payroll Metrics characteristic.

An expense report is created that exhibits all bills, resembling employees salaries, contributions, advantages, state and federal taxes. You may export such experiences to different enterprise intelligence instruments for in depth evaluation.

#6. Payroll administration

Payroll is a vital a part of any normal payroll software program. First, it permits you to handle app entry for payroll staff, supervisors, and managers.

Second, when you handle a distributed workforce the place staff or contractors are stationed within the US or overseas, Payroll Administration helps you to create totally different work places so you’ll be able to simply observe worker funds.

Zoho Payroll: Advantages for Staff

- Receives a commission on time for correct work hours, with no disputes arising.

- Adjust to federal taxes simply and effortlessly.

- Receives a commission securely and simply by way of financial institution switch.

- Entry payroll paperwork resembling payslips, tax kinds, and so forth. from a self-service platform.

Zoho Payroll: Advantages for Startups

- Take management of your payroll by permissions and role-based entry.

- Give attention to product/service advertising and investor relations by automating the whole payroll system for funds, taxes, perks, and so forth.

- Creates a self-service system for handing out tax kinds, proof of funding kinds, pay slips, and so forth.

- Reduces your personnel bills on payroll.

Zoho Payroll: Small Enterprise Advantages

- It precisely calculates worker funds and protects your organization’s money towards pointless losses.

- Assess and put together taxes with ease, whereas saving quite a lot of time within the course of.

- Automated and safe wage funds by Forte.

- It syncs with Zoho Books for payroll knowledge and makes the entire course of seamless.

Zoho Payroll cell app

The Zoho Payroll cell app works along with the web-based kiosk as a self-service portal for workers. Your staff can obtain the app from the Apple Retailer and Play Retailer for his or her respective smartphones.

Staff can visualize their pay slips and pay slips from this cell app. They will additionally get an in depth overview of the compensation plans from the identical software. As well as, your employees can plan their day without work by checking PTO balances and insurance policies from throughout the instrument.

Zoho Payroll Options

OnPay

OnPay is a payroll instrument that additionally contains HR and worker advantages. It is a web based net app, so accessing and working the instrument is simple. As well as, it has an extended record of enterprise sorts so that you can select from. For instance, you’ll be able to select startups, skilled entrepreneurs, agriculture, dentists, eating places, NGOs, accountants, and so forth.

The app facilitates the fast and straightforward onboarding of latest staff, contractors and suppliers. This lets you hyperlink and manage all of your staff’ paperwork and funds in a single safe app. As well as, you’ll be able to combine the instrument with different monetary purposes resembling Xero and QuickBooks.

Rippling

Ripple is a full-service and totally automated fee processing instrument for small to giant companies. It helps tax withholding, payroll, advantages and authorized compliance for all 50 states of the USA of America. Furthermore, you’ll be able to simply take care of worldwide staff and contractors because the instrument additionally has the mandatory functionalities.

Along with computerized compliance with worker knowledge and tax returns, the app additionally gives different important functionalities resembling paid day without work (PTO) monitoring, work hours monitoring, working day registration and detailed payroll reporting. As well as, the job code characteristic permits you to visualize which worker prices you what for which buyer and how one can save much more.

Patriot software program

Patriot Software program is yet one more in style worker fee processing instrument. Along with the payroll module, it additionally comes with a full-fledged accounting characteristic, must you select to subscribe. For the reason that app is totally on-line and mobile-friendly, startups in varied industries and seasoned firms use this instrument to deal with payroll.

Relying on the scale of your organization and the complexity of your payroll administration, you’ll be able to select between a fundamental and a full payroll administration. Within the fundamental plan, you are able to do payroll on your staff and file taxes your self. Quite the opposite, in case you are extremely concerned in revenue-generating duties, you may get the full-service plan the place the Patriot Software program group will file and remit federal taxes.

final phrases

The overview should unequivocally clarify the enterprise options of Zoho Payroll. The article additionally helps you make strategic selections when it’s worthwhile to select the fitting payroll administration app on your startups, small and medium companies.

It’s also possible to use the instrument for enterprise degree companies because it gives a versatile scaling choice. Request a free trial of the app now and expertise the distinction and productiveness options you are on the lookout for.

Additionally take a look at ADP HR and Payroll Options.