Tokenomics encompass necessary components by which you’ll be able to decide the worth of a crypto token.

The demand for cryptocurrency has been on the rise since early 2023. Lastly, most cryptos began to rise after the unfavourable market sentiment in 2022. As well as, the worldwide crypto market is valued at over $1 trillion.

Bitcoin, the biggest cryptocurrency, gained over 40% in January 2023. Have you learnt how crypto is valued? If the reply isn’t any, don’t fret. We talk about this on this article.

For crypto, Tokenomics provides worth based mostly on a number of parameters. However earlier than we get into Tokenomics, we have to perceive crypto tokens.

What’s a crypto token?

A crypto token is a digital token that represents varied property similar to actual property, securities and even digital artwork. As well as, a token also can symbolize a selected use on a specific blockchain.

The worth of a token is decided by the worth of the underlying asset or its use. Equally, increased market demand for a token also can improve its value.

Now that you already know a bit a few token, let’s dive into Tokenomics.

What’s Tokenomics?

Tokenomics is a mixture of ‘token’ and ‘economics’. Merely put, Tokenomics is the economics of a crypto token.

The unique thought of Tokenomics was proposed by BF Skinner, a Harvard psychologist. In 1972, Skinner recommended exchanging tokens amongst members over espresso or sweet.

Tokenomics is predicated on the inducement mechanism that rewards individuals who use blockchain networks. This technique motivates folks to take part in crypto tasks which have extra reward potential.

Within the case of crypto tasks, the traders purchase and maintain tokens that they consider shall be rewarded sooner or later. The higher the demand for tokens, the extra worth is added to the venture and the invested fund.

You will have an fascinating query: “How can I test the tokenomics?” Let’s get proper into that!

How do I test the tokenomics of a Crypto venture?

Tokenomics helps you a large number in understanding the construction and design of a crypto token. Here is the best way to perceive crypto venture tokenomics:

#1. Examine the white paper

Most crypto tasks publish a white paper with technical specs and key aims. Right here you’ll be able to learn your entire venture and get a primary understanding of it.

Some tasks additionally publish a lite paper, a simplified model of the white paper. So you’ll be able to learn a Litepaper to grasp with out jargon.

Tokenomics consists of a necessary a part of a white paper. You may learn all the main points associated to the token and its functionalities.

#2. Go to pricing web sites

Digging right into a white paper and extracting the necessary tokenomics might be hectic and time consuming. In case you are in the same scenario, go to actual value monitoring web sites.

You may go to easy platforms like CoinMarketCap or CoinGecko for a fast evaluation of a venture’s tokenomics. These platforms present all related particulars without delay.

Right here, the principle profit is setting your most popular fiat foreign money to judge a token’s tokenomics. Furthermore, you do not even have to log in to seek out the token particulars. Spectacular proper?

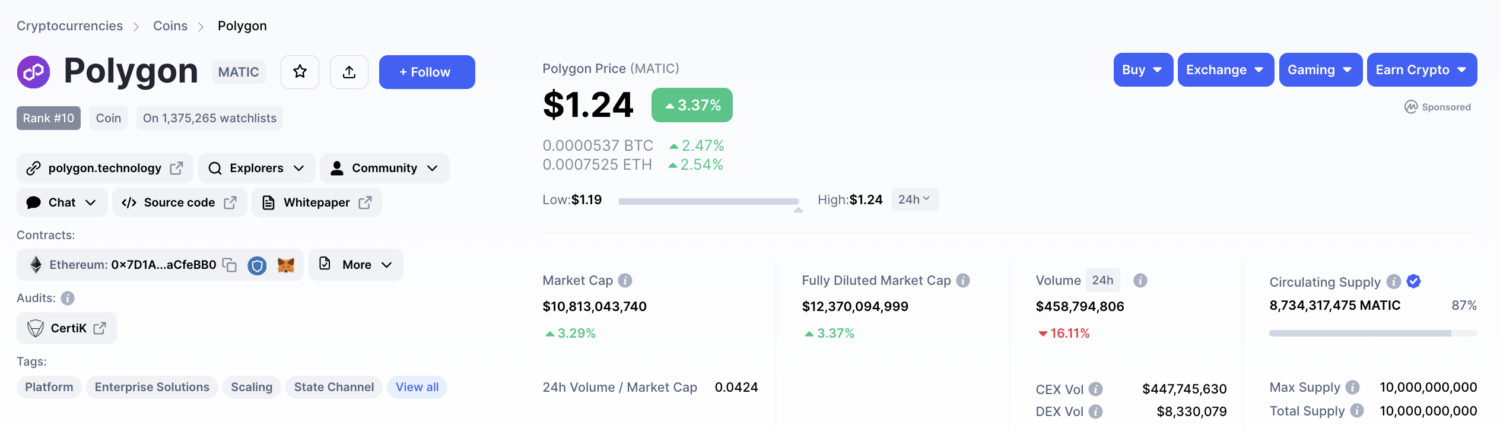

As an example you seek for the tokenomics of the Polygon venture’s MATIC token. You can find the real-time market capitalization values and the circulating provide.

As well as, you may also discover out the historic knowledge of the token since its inception. Furthermore, the main points of the preliminary coin providing (ICO) can be found in a single click on.

In brief, it is very important test the important thing parts of tokenomics to achieve extra readability a few venture.

Let’s dive proper in!

Key Elements of Tokenomics

#1. Token supply

The principle components that affect the value of a token are its provide and demand. There are three kinds of choices for a token; circulating provide, whole provide, and most provide.

- Circulating supply: This quantity consists of the whole variety of tokens at the moment circulating within the crypto market.

- Complete supply: The entire provide of a token consists of the circulating provide and the variety of tokens which might be mined however not out there available on the market. Furthermore, the whole provide additionally doesn’t embody the burned tokens.

- Most supply: This provide consists of the utmost token that the venture has coded to mine or spend.

As well as, the availability of tokens helps to seek out the crypto market cap or market capitalization of a token. The market cap is calculated by multiplying the present value of the token by the circulating provide.

Let’s assume a token is buying and selling for $20, and the circulating provide is 10 million. The token on this case has a market cap of $200 million.

Some tokens have a most provide, such because the ADA token from the Cardano venture. ADA has a most provide of 45 billion tokens. Nonetheless, tokens from tasks similar to Shiba Inu, Polkadot and Tether should not have a most provide.

#2. Consensus mechanism

The consensus mechanism of a crypto venture permits the blockchain community to validate and safe each transaction. Most tasks use proof-of-work (PoW) or proof-of-stake (PoS) mechanisms.

The PoW mechanism rewards its miners after they full the validation of the transactions. Nonetheless, the miners require subtle pc gear to carry out the validation course of.

In contrast to PoW, proof-of-stake mechanisms permit you to confirm the community transaction by staking crypto tokens. Due to this fact, you have to stake tokens for a restricted time period to obtain rewards.

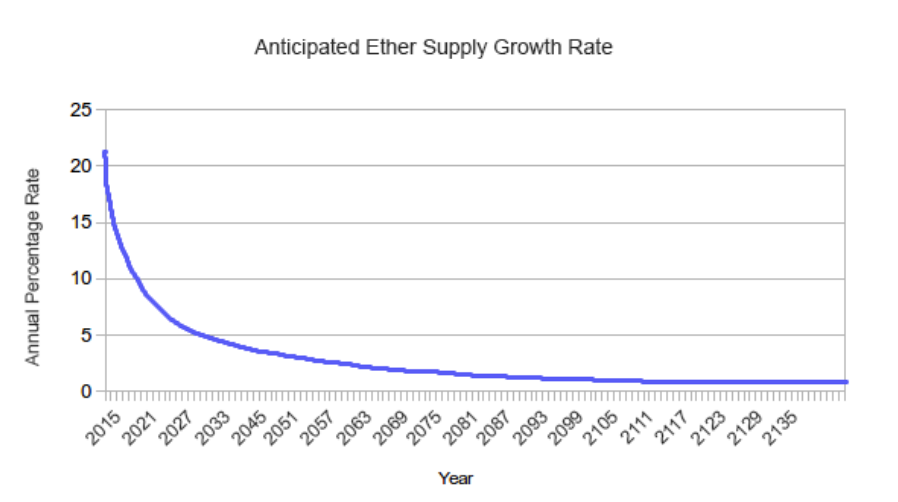

A lot of the new blockchain tasks want an environmentally pleasant mechanism, so PoW has turn into extremely popular currently. Ethereum’s shift to a staking mechanism is likely one of the main milestones within the crypto trade.

#3. Token utility

The token utility is the precise use of a crypto token. The builders of the crypto venture select their token’s utility based mostly on the mission of the venture.

Some tokens enable customers to pay transaction charges, whereas others can be utilized to purchase or promote NFTs. As well as, you probably have governance tokens, you’ll be able to vote on a venture’s key decision-making course of.

Play-to-ear gaming tasks reward their gamers with tokens. Gamers can use these tokens to buy in-game objects.

For health fanatics, there are move-to-ear tasks that encourage customers to train. Right here you’ll obtain utility tokens as a reward based mostly in your bodily actions.

Some tasks concentrate on stablecoins. On this case, the token shall be pegged to a fiat foreign money such because the US greenback. As well as, the worth of the token stays near the worth of the corresponding foreign money.

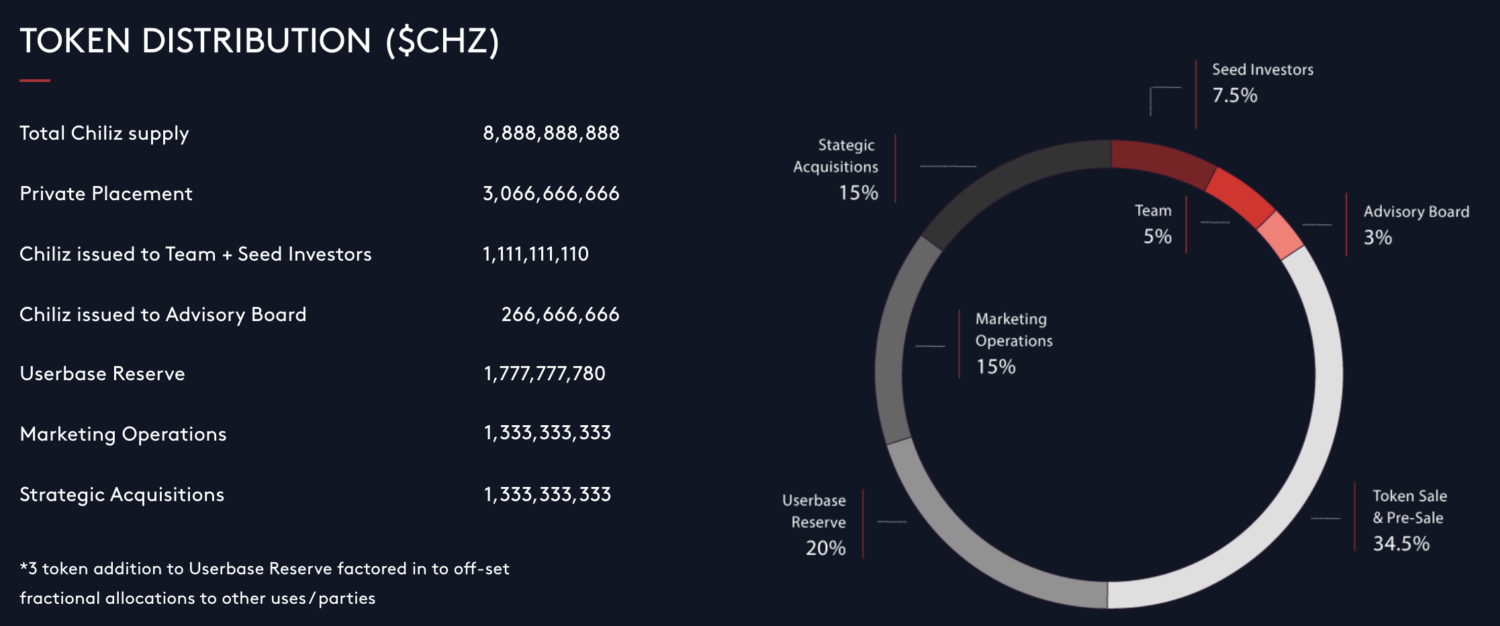

#4. Token distribution

A big portion of the token provide is usually distributed among the many founders and traders of a crypto venture. So it’s essential to know the conduct of massive farmers.

Suppose a person or a corporation with loads of property sells all of its tokens. In that case, the value of the token can fall and even crash significantly.

It’s also possible to test if the traders or founders have a minimal lock-in interval to promote their tokens. The longer this era, the smaller the danger of an enormous sale.

As well as, the token distribution consists of the proportion of the whole token allotted for advertising and marketing. As well as, tasks allocate a small share to the staff members. For instance, Chiliz crypto tasks allocate 5% of their whole token provide to the staff.

An Preliminary Coin Providing (ICO) is likely one of the most most popular methods for crypto tasks to distribute their tokens to patrons. In case you are within the imaginative and prescient of a venture, you’ll be able to take part in its ICO.

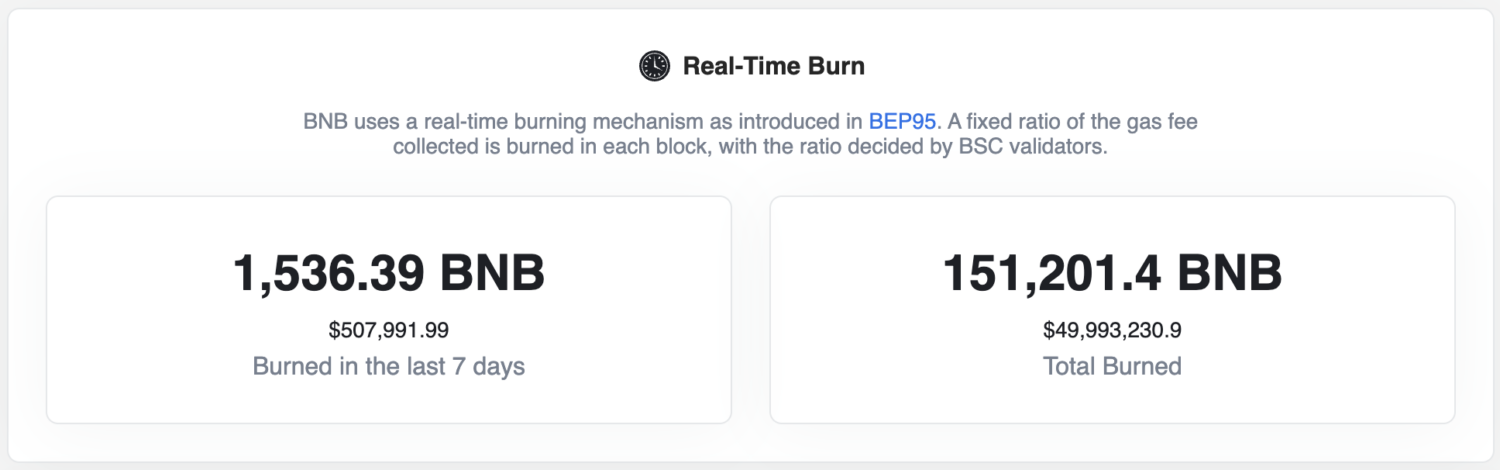

#5. Token burns

Burning a token means eradicating numerous tokens from the circulation pool. On this case, tokens are transferred to an inaccessible pockets.

Burning token completely removes the token from existence. Usually, the builders burn tokens to cut back the availability of that specific crypto token.

Binance Coin (BNB) is understood for its token burning course of. On the time of writing, the Binance venture has burned over 150,000 BNB tokens.

Significance of tokenomics in crypto investments

Tokenomics is likely one of the necessary components traders take into account earlier than buying crypto tokens. With Tokenomics, traders can:

#1. Perceive danger

Tokenomics play a significant function in offering sufficient elementary particulars relating to a token. Primarily based on this knowledge, an investor could make a tough danger evaluation.

When you take into account the token of a crypto venture to be very dangerous, you can also make an funding determination accordingly. Right here you’ll be able to keep away from a dangerous venture or allocate a minimal quantity to steadiness your total danger publicity.

#2. Search for pink flags

Crypto tokens are listed each day and it’s troublesome to identify unhealthy tasks. That is the place tokenomics may help you discover tokens with unhealthy fundamentals.

For instance, say you discover a token whose majority of distribution lies with a single founder or investor. On this case, it’s higher to not spend money on that token. Right here, a single token holder can crash the token value.

#3. Consider the worth of the token

As we mentioned earlier, tokenomics permits us to estimate the market cap of a crypto token. This worth helps to match the token with different tokens of comparable market capitalization.

Usually, the market cap of probably the most demanded tokens continues to extend over time. For instance, Bitcoin tops the listing with a market cap of over $442 billion.

#4. Decide future potential

A well-structured tokenomics mannequin permits traders to find out the capability of a crypto venture to realize its purpose. It’s also possible to confer with the roadmap on the white paper to foretell the expansion of a venture.

Evaluating the potential worth of a token will enable you take into account your funding determination. Merely put, you’ll be able to steer clear of shoddy crypto tasks.

Final phrases

Tokenomics of a crypto venture entails a number of precious knowledge. This knowledge helps to seek out out the worth of a crypto token.

It isn’t straightforward to find out a token’s potential by taking a look at a single parameter. For that reason, combining all of the parameters talked about on this article is greatest for higher token valuation.

In the end, do your individual analysis (DYOR) earlier than shopping for crypto tokens.

You may additionally be all for crypto index funds and ETFs.