This finest crypto tax software program takes away your post-trading headache by calculating your crypto tax liabilities in only a few clicks.

Cryptocurrency is likely one of the hottest buying and selling alternatives proper now. Verify this out:

Bitcoin is up over 4000% previously 5 years. In the identical interval, Ether shot up a whopping 25,000%!

In brief, cryptocurrencies are driving a mighty wave that traders do not need to miss.

However whenever you speak about crypto taxes, folks begin scratching their heads

Some consider that crypto earnings will not be taxable as a result of crypto just isn’t but authorized of their nation.

Effectively, perhaps they’re useless mistaken.

Since virtually any occasion of shopping for, promoting, or exchanging cryptocurrency qualifies as a taxable occasion, this is applicable even when your authorities has but to legalize crypto.

You’ll be able to keep away from crypto taxes in the event that they fall into the exempt earnings class in your state.

So when you can see large earnings (and losses) with cryptocurrencies, it is vital to pay taxes accordingly and adjust to the tax legal guidelines.

However since we’re not all chartered accountants, these finest crypto tax software program will turn out to be useful. It provides you extra time to deal with buying and selling and never waste hours miscalculating your crypto taxes.

So let’s dive proper in to take a look at the very best crypto tax software program.

Foreign money ledger

CoinLedger has launched completely for the USA. Ultimately it added assist for Australian customers, and now anybody can use this platform if their nation helps FIFO, HIFO, or LIFO reporting strategies.

CoinLedger has a clear person interface and loads of assist to get you began. They assist many platforms like Binance, Coinbase, Exodus, and so on.

There are detailed guides on how one can import trades from every platform. Some crypto buying and selling platforms even have automated import performance.

You too can invite your earnings tax skilled to view and obtain the report from the dashboard.

CoinLedger permits free report previews and information import. As well as, you may add limitless exchanges and sync your DeFi transactions.

Subscription plans are based mostly on the variety of transactions throughout a fiscal 12 months.

Matching

You’ll be able to calculate crypto tax and observe belongings utilizing Accointing. And the free tier allows crypto tax calculation for as much as 25 transactions.

Just like the others on this checklist, you should utilize this instrument in case your nation helps FIFO, LIFO, and HIFO reporting strategies.

Accoting permits you to combine with quite a few exchanges and wallets with API keys. As well as, you might be free to carry out CSV uploads or manually enter every transaction.

It additionally has a Buying and selling Tax Optimizer that lists trades to reduce your crypto taxes. And with the Accointing crypto tracker you’ve got a central place to observe your crypto portfolio.

Lastly, along with the net interface, Accointing additionally has purposes for Android and iOS platforms.

Coin panda

Coinpanda needs to be your go-to crypto buying and selling tax answer if you wish to begin with out paying a dime. The free possibility is filled with options and solely misses a couple of which might be reserved for the highest plan.

You generate your crypto earnings from all kinds of choices: mining, staking, forks, airdrops, presents, donations, and so on.

Customers with tax regimes that permit FIFO, LIFO, ACB, Share Pool, and so on. can use this crypto tax calculator software program.

Coinpanda helps over 7000 cryptocurrencies. You should utilize the same old API syn and CSV to import information from quite a few alternate platforms.

Nonetheless, the free plan solely permits for 25 transactions, which is okay contemplating the options you get.

Lastly, you may add as many exchanges as you need with this finest crypto tax software program.

Token tax

TokenTax is the same crypto accounting utility that helps FIFO, HIFO, and LIFO reporting strategies.

Their primary plan solely helps Coinbase and Coinbase Professional accounts. And you’d improve to their larger tiers to make use of a number of exchanges.

Plus, you may’t do something with out signing up for subscriptions.

That mentioned, the interface is intuitive. API keys assist you to combine many exchanges. As well as, TokenTax additionally permits handbook entry/CSV add of transaction information.

You’ll be able to subscribe based mostly on the variety of transactions, alternate assist, and some different options.

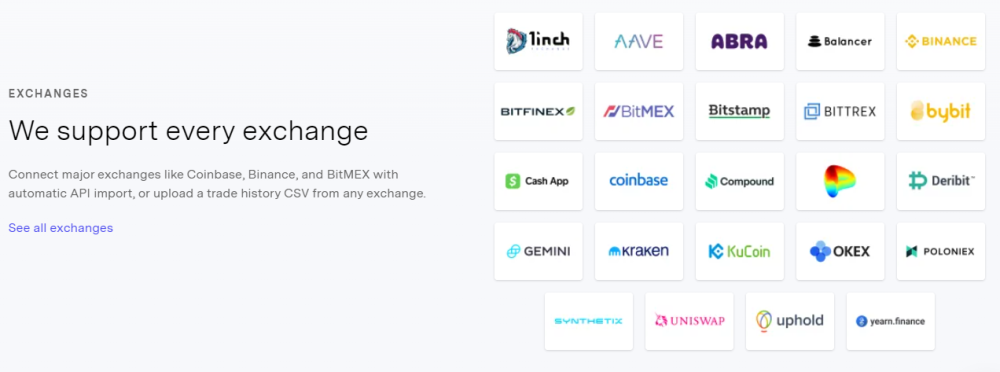

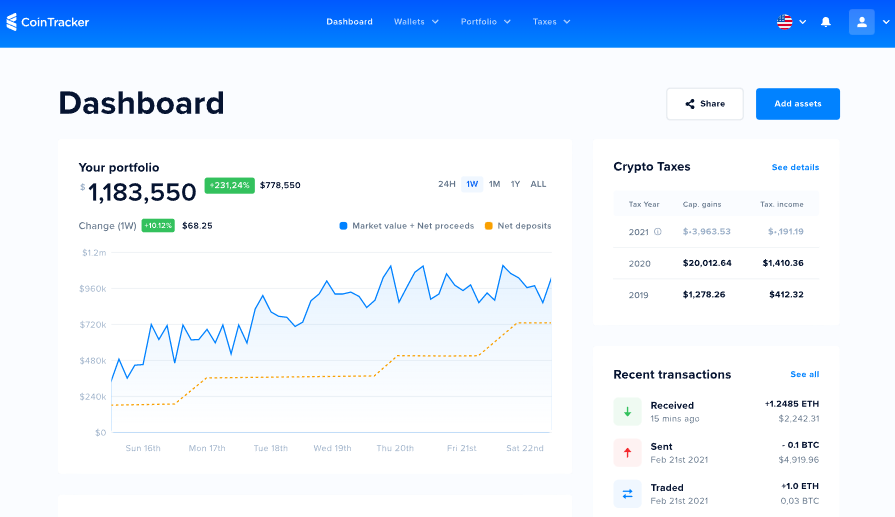

CoinTracker

CoinTracker is likely one of the finest crypto tax software program because it comes with a free tier for newbies. You are able to do as much as 25 transactions with it with out paying something.

Nevertheless it does extra than simply crypto accounting. As well as, this platform tracks the efficiency of your portfolio and helps you handle it to get probably the most out of it.

They at present assist over 300 exchanges and 8000+ cryptocurrencies.

You too can add standard exchanges with API keys. As well as, it’s also possible to carry out a CSV add or manually add information and preview the tax influence.

Much like CyrptoTrader, CoinTracker permits you to share the report with tax professionals. Subscription plans are transaction-based, and higher-tier plans additionally include DeFi assist.

Koinly

Koinly has a really beneficiant free plan that permits for as much as 10,000 transactions with numerous additional options. It helps widespread FIFO, LIFO, common value foundation, and so on. for tax accounting.

It helps information import (API & CSV) from greater than 350 exchanges, 50+ wallets and 15 blockchains.

Catering to over 17,000 crypto cash, Koinly permits you to observe all crypto holdings in a single place.

It could possibly report lacking transactions and take away duplicate entries. All Koinly plans (together with the free ones) are appropriate with DeFi, Margin and Futures buying and selling.

TaxBit

TaxBit is built-in with over 500 crypto exchanges, wallets and DeFi platforms. This crypto solely has native assist for United States taxpayers. Nonetheless, the platform states that anybody with related tax regimes can use it.

TaxBit has a free without end plan for particular person clients that permits for limitless transactions. You too can combine numerous associated providers, in order that all the pieces is on one dashboard.

TaxBit’s tax optimization permits you to notice capital positive factors and losses earlier than each commerce.

Specifically, some options, akin to tax optimization, tax loss assortment, and IRS audit assist, are reserved for the upper ranges.

BitcoinTaxes

BitcoinTaxes permits you to calculate your crypto taxes utilizing FIFO and particular identification accounting strategies.

You’ll be able to import your trades from standard crypto alternate platforms akin to Binance, Coinbase, Exodus, Kraken and plenty of extra.

BitcoinTaxes additionally has the choice to add transaction information manually.

One advantage of this instrument is that even the free tier has the identical options as the very best plan. The one limitation you get is the variety of transactions (as much as 20) with the free without end plan.

You too can interact crypto tax professionals that can assist you put together your tax return. As well as, additionally they provide providers akin to CSV file conversion, outcomes evaluation, customized report creation, and so on.

Zen Ledger

ZenLedger is a high crypto tax software program with extensive assist for numerous exchanges through API keys and CVS uploads.

It’s appropriate with HIFO, LIFO and FIFO reporting strategies. ZenLedger permits you to have limitless alternate platforms. As well as, you may report a wide range of crypto earnings, together with DeFi, NFTs, staking, donations, mining, and so on.

ZenLedger has two subscription classes: DIY and Tax-professional-assisted.

For sure, the previous is extra economical, with a free tier that permits as much as 25 transactions. And even this free plan has all of the options of the paid plans other than assist for DeFi and NFTs.

The latter class additionally presents a consultation-only possibility, which is considerably cheaper. You’ll be able to go for that after which proceed with the DIY plans as a cost-effective different.

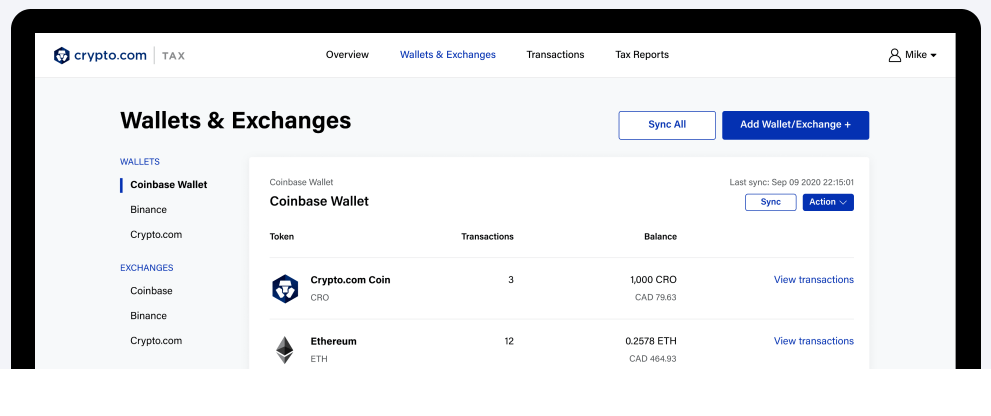

Tax.Crypto

The most effective factor about Tax.Crypto is that there is no such thing as a paid subscription. It is fully free. This utility supplies native assist for Germany, UK, US, Canada and Australia.

One can add wallets and API keys to sync the transactions.

Presently, solely standard exchanges within the listed jurisdictions ship with API synchronization. Nonetheless, there’s all the time an choice to format and add a CSV to calculate your crypto taxes.

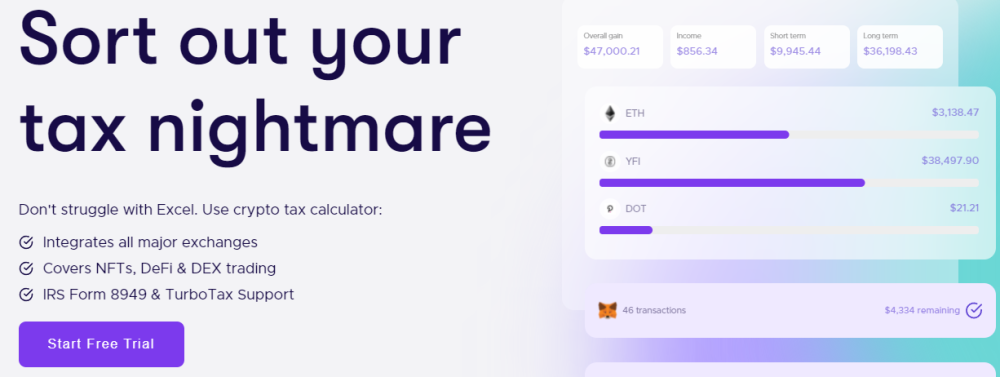

Crypto Tax Calculator

Crypto Tax Calculator is a premium crypto tax accounting utility. The checklist of options is certainly lengthy and depends upon your plan.

They’ve a full checklist of supported exchanges. Whereas worldwide traders can use this software program, it’s sensible to verify the tax submitting methodology beforehand.

This instrument doesn’t have a free tier. As an alternative, it comes with a 30-day free trial. You’ll be able to import information, calculate taxes and think about transactions with the trial model.

Nonetheless, for annual monetary reporting, you’ll want to subscribe to the paid tiers. And sure, information add through API keys and CVS uploads are supported.

encryption

You’ll discover that Cryptio is similar to the earlier possibility. First, there is a free trial to make up for the shortage of a free tier. And second, there are many subscription-based options.

Nonetheless, this selection is aimed toward tax accounting corporations. Your present firm and designation particulars are listed on the registration kind.

Cryptio can assist you in case you are a crypto-native firm coping with DeFi options, blockchain video games, metaverses, and so on.

You’ll be able to subscribe to the total 14-day trial to see if it is best for you.

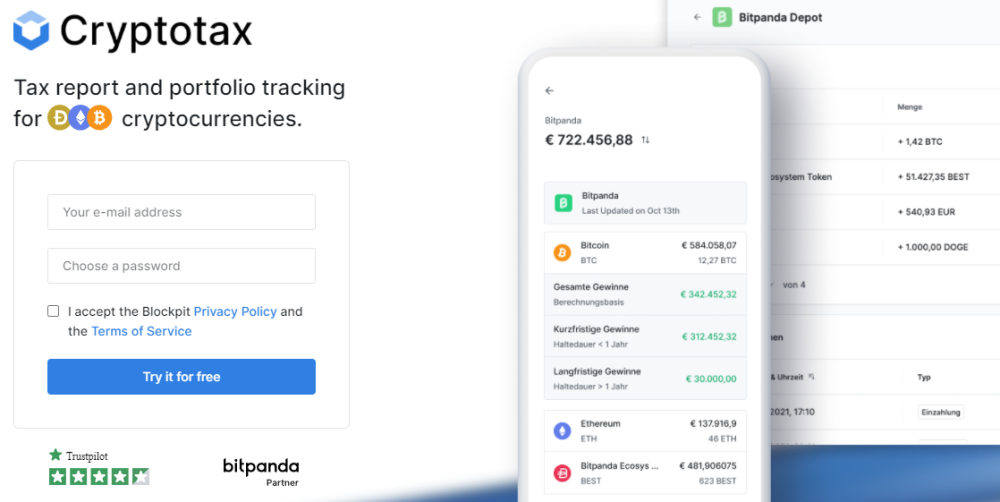

CryptoTax

Blockpit’s CryptoTax helps you adjust to the tax legal guidelines of the US, France, Spain, Germany, Austria and Switzerland.

They assist the preferred exchanges together with Binance, Coinbase, Kraken, and so on.

API and CSV import services can be found. Whilst you can import a limiteless variety of transactions, the free tier limits your tax return to a most of 25 transactions.

This crypto tax software program comes with automated transaction classification and error checking. Furthermore, you may observe the crypto load from a large spectrum of sources.

Conclusion

Taxes are a mandatory evil that we can’t escape.

Specifically, the features talked about beneath the instruments will not be exhaustive. So it’s higher to analysis this totally earlier than signing up for crypto tax software program.

need extra! Try our complete checklist of measures to safe your cryptocurrency.