Private Finance instruments provide help to handle your investments, monitor them commonly and ensure you’re on monitor to succeed in your monetary targets.

It is important to know what occurs to your whole investments, not simply annually whenever you get your tax varieties. Fortuitously, there are funding administration apps that may assist. They monitor and monitor your portfolio for any modifications which will have an effect on you.

Your portfolio can embody shares, bonds, mutual funds, ETFs, 401(okay)s, or IRAs. Conserving monitor of all these belongings generally is a difficult, if not a frightening activity.

Think about sitting comfortably in your favourite chair and with the ability to handle your funding portfolio throughout all accounts. It’s potential to see your web price by month, week, day and even second with private finance instruments and apps.

Our record of the most effective private finance instruments and wealth administration apps consists of the most effective paid and free selections to attain all kinds of monetary targets. Take a look at these to arrange your funds now.

M1

M1 Finance is a one cease store for all of your monetary wants. Their Make investments characteristic permits you to customise your investments the way in which you need without cost! The mortgage characteristic additionally permits you to borrow in opposition to your funding at 2-3.5% with none further paperwork. Lastly, with their Spend characteristic, you get the most effective digital banking built-in along with your investments effortlessly.

M1 Finance is a hands-free funding technique for long-term buyers. The platform is designed to provide the excellent mix of personalization and automation so you can also make cash. It takes care of the day-to-day duties so you possibly can concentrate on the massive image and it is free to make use of – not like different funding platforms, which cost platform utilization charges or make deposits or withdrawals along with your affiliate financial institution.

You’ll be able to set your percentages manually or let M1 do it for you. It additionally presents Dynamic Rebalancing, the place everytime you add new cash to your portfolio, it robotically identifies underweight segments and invests the quantity wanted to get them again on monitor.

The Auto Make investments characteristic retains your portfolio on monitor in your aims, so that you by no means need to guess what you are investing for. Plus plan members get a 1.5% base charge lower on borrowing, entry to their afternoon buying and selling window, and 1% money again and 1% APY with the spending account.

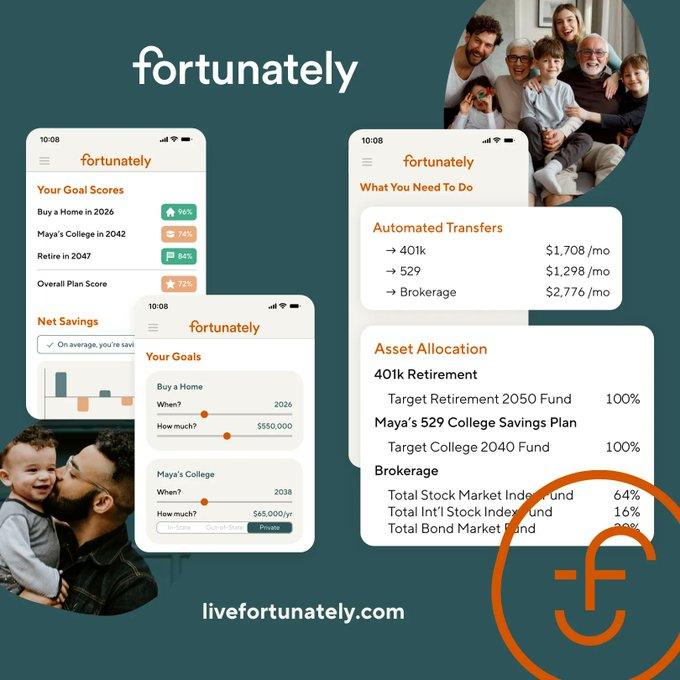

Completely satisfied

Completely satisfied is straightforward to make use of and offers a complete view of the person’s whole monetary portfolio, together with mortgages, investments, retirement planning, childcare prices, focused financial savings, and taxes. It additionally, and maybe most significantly, offers timelines for when and wherein accounts you possibly can make investments your cash to attain your targets.

The intuitive software program replaces the traditional technique of managing funds, eradicating price and complexity and proposing distinctive plans to attain development and particular person monetary targets. The platform analyzes your whole monetary image to find out your perfect path to success earlier than making a customized answer to extend the probabilities of reaching your targets.

Among the vital options are:

- Fixed monitoring of your portfolio and updates when enhancements are wanted.

- Sensible recommendation consists of switching to much less dangerous investments when targets are shut, and optimizing for development when targets are additional away.

- Personalised planning is predicated on an examination of the precise state of affairs, shopper aims and business finest practices

Fortuitously, it presents an end-to-end answer to attain your monetary targets, no matter your present monetary state of affairs. With the free model you possibly can create your monetary plan in lower than 5 minutes. If you’d like steady monitoring and recommendation, just like what you’ll pay hundreds of {dollars} for from a monetary planner, you possibly can improve for simply $5 per thirty days.

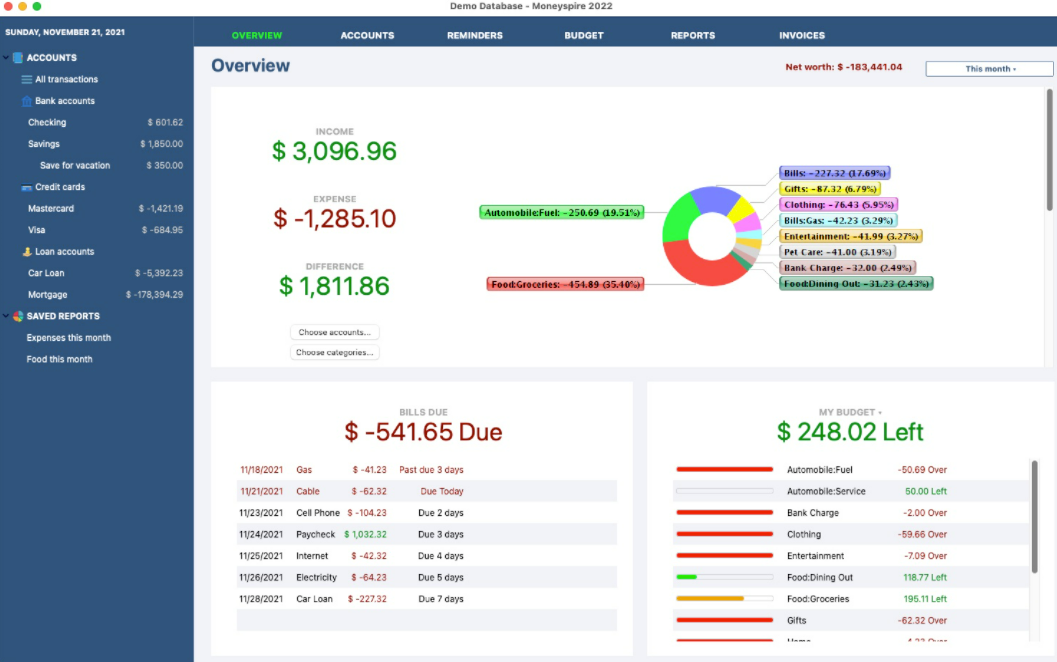

Cash Spire

Moneyspire is the non-public finance software program that manages budgeting for customers. It helps handle the cash because it dives deep into the person’s sample and spending. It permits:

- Perceive the funds that historical past is part of and the way it will affect future choices.

- Customizable interactive stories.

- Perceive the transactions and balances to arrange plans for upcoming bills.

- Reminder for customers to pay payments.

- Set price range and targets to make sure customers perceive real-time metrics.

- Immediately create and monitor buyer invoices.

The software program presents totally customizable options for customers to arrange their funds, helps world currencies and areas making it simpler for everybody, transfers monetary knowledge from different software program shortly, manages the info with none third occasion involvement, and many others.

56-bit encryption for transferring banking data to maintain the knowledge personal.

Empower (previously private capital)

Empower is an app that enables customers to trace their bills and think about their funding portfolios. You’ll be able to hyperlink all of your accounts collectively for straightforward administration and monitoring. It may be used to calculate your web price, supplying you with an concept of your present place and setting a objective for the long run. It presents monetary planning recommendation that helps you create a tailored monetary plan.

Empower is exclusive in that it presents each superior cell apps and an intuitive desktop interface. It could actually additionally analyze your accounts to uncover hidden prices which may be stopping your portfolio from reaching its full potential.

Anybody can join and get free entry to the cash planning instruments. Nevertheless, to qualify for the advisory companies it’s essential to have a minimal of $100,000 in an account.

Your knowledge is protected with military-grade encryption algorithms, 256-bit AES. Firewalls that work in keeping with strict monetary and worldwide safety requirements (PCI DSS Stage 1 and ISO 27001 certification) shield your knowledge. Info safety is underneath direct administration management.

Determine

Digit is designed for individuals who wish to get monetary savings however do not thoughts placing in plenty of effort. This service evaluates your spending habits after which transfers cash to your Digit account out of your linked checking account. It interprets your test stability, future revenue and spending patterns. It makes use of these variables to calculate a non-essential quantity based mostly in your spending habits.

You could be pondering, “Wait! Cannot I do issues like this myself?” Digit is designed for the technology that trusts expertise implicitly and depends closely on it. It is price it for the comfort and price.

All clients obtain a 1% annual financial savings bonus for each three months they save. It additionally presents an SMS service that makes use of textual content messaging to permit clients to view their balances, withdraw cash and think about upcoming payments with out utilizing a pc.

Digit was created to assist tech-savvy millennials save extra. It’s FDIC insured as much as $250,000. You’ll be able to by no means switch greater than you possibly can pay and there’s no overdraft assure.

Enchancment

Enchancment can assist you handle your cash by money administration, guided investments and retirement planning. While you hook up with your exterior accounts, additionally they accumulate data. It helps you set monetary targets and construct funding portfolios that help every plan.

The funding technique is predicated on ETFs (Change Traded Funds) which can be low-cost and have a danger profile based mostly on the size of your funding plans. You should use their money administration, checks and cash reserve merchandise to save cash and spend much less.

Betterment Securities is a SIPC member and protects securities purchasers as much as $500,000 (together with $250,000 money claims). Deposits on Checking could be insured as much as a most of €250,000 on particular person accounts and €250,000 per depositor on joint accounts.

Wealth Entrance

Wealthfront is among the finest Robo advisor apps obtainable out there. It presents the entire bundle of planning, investing, banking and objective setting planning in a straightforward to make use of platform.

The accounts offer you free entry to Path, a monetary planning software that integrates account data and makes use of third-party knowledge to higher predict your monetary future.

The improbable monetary planning helps you see the larger image. For vital targets, corresponding to school financial savings and residential purchases, objective setting assist is obtainable. It presents advantages corresponding to a Line of the Credit score portfolio, instruments that will help you make the best choice you probably have a number of targets, and tax loss reduction.

There is no such thing as a on-line chat obtainable for potential or present clients. Bigger quantities of mutual funds could also be obtainable in bigger accounts.

Speed up

Quicken will get excessive marks for its personalised spending plan that provides you real-time updates on how a lot cash you may have left over every month. It syncs along with your financial institution accounts to trace your monetary progress and present you the place you might be. Quicken’s Simplifi retains monitor of all of your subscriptions and invoices, even those you do not use.

It has a retirement planner, funding tracker, and even a property administration part to handle all of your investments in a single dashboard. It additionally has a capital beneficial properties calculator in case you promote your belongings.

To get began, it is advisable to hyperlink your financial institution accounts. When you try this, you will have an entire image of your funds. The app robotically categorizes and tracks your bills and notifies you of any upcoming bills.

The app’s distinctive watchlists permit you to restrict your spending by beneficiary or class. The app’s customized spending plan screens your money stream so you do not spend greater than you earn.

Quicken, the app’s mum or dad firm, is dedicated to privateness and safety. They proceed to develop and use new safety measures 2

ZakBlacksmith

PocketSmith is a budgeting and private finance software program that may assist to chart the person’s monetary paths in three simple steps, achieve perception into the previous, perceive the present monetary standing and set up the funds for the long run.

The software program offers detailed data and historic reporting to grasp the sample, management spending, make an knowledgeable choice, and perceive the affect of choices on the long run. The primary options of PocketSmith are:

- Customizable cash plans to attain the targets

- Cash administration system with all important particulars

- Discovering the best answer in keeping with the price

- Computerized financial institution suggestions

- Money stream forecast

- A number of currencies

Conclusion

Private finance apps proceed to achieve recognition. As a result of the apps are really easy to make use of and commonplace, budgeting has turn out to be fashionable. Future developments will prioritize a extra environment friendly, quicker and simpler app expertise.

Safety might be a prime precedence, particularly given considerations about cybersecurity breaches. As a result of each particular person’s state of affairs is exclusive, it’s troublesome to present normal suggestions for private finance apps.

One factor is for certain, nevertheless. The world has modified. Private finance apps are actually part of on a regular basis life. The millennial technology continues to embrace monetary purposes and alter the way in which they do enterprise.

Listed below are some nice apps for investing in shares and ETFs.