Private budgeting software program helps you propose your bills, inculcate a saving behavior, observe your investments, debt and allow you to attain your monetary objectives.

What are private budgeting and private budgeting software program?

Budgeting refers back to the creation of a plan for the way you’ll spend your cash. It merely means the way you steadiness your earnings and bills. In case your prices aren’t balanced and also you spend greater than you earn, you may have an issue. Many individuals don’t understand that, and so they spend extra. They save lower than they make and sink deeper into debt annually.

Private budgeting software program and functions can help you in mastering the fundamentals, get extra environment friendly in managing your funds, and help you to find methods to succeed in your monetary objectives for the longer term.

Why do you want a private funds & why use private budgeting software program?

Even when you don’t have a selected aim like paying off debt or saving cash, having a private funds might help you be extra financially wholesome. You’ll be able to keep away from overspending and plan for future bills by holding observe of your cash. It permits you to visualize how a lot you’re spending and what you’re spending on.

The very best private finance software is predicated in your monetary state of affairs. Software program for private budgeting helps you study budgeting and monitoring bills and help in managing your funding portfolio.

How a lot does a budgeting software program value?

A couple of budgeting functions are free, whereas others value an annual or month-to-month price. The typical value of those functions is between $5 to $12 monthly. Paid variations of software program typically provide higher-quality options and higher help to prospects than the free alternate options.

Our high private finance functions checklist consists of the very best paid and free decisions to fulfill a variety of monetary goals. Test it out and ensure your financials are organized inside a matter of minutes.

Empower (Beforehand Private Capital)

Empower is without doubt one of the finest decisions for buyers because it affords a strong budgeting program and financial savings and retirement planning. It lets you hold observe of the investments you make. Empower permits you to observe the worth of your belongings, hold observe of your money circulate, and even get an funding report so as to observe your funds multi function spot.

Options

- Free to make use of.

- An entire monetary dashboard might help you monitor each facet of your funds.

- Funding and retirement planning options to help you in reaching your monetary objectives.

Empower integrates budgeting software program alongside different monetary instruments on the identical monetary instrument. You’ll be able to observe your spending and monitor the efficiency of your investments in real-time, in addition to set retirement objectives and watch your internet price. Moreover, you possibly can entry unique options, corresponding to an funding check-up that analyses your asset allocation by your age and circumstances.

The characteristic for checking your investments is just obtainable within the desktop model. Nonetheless, each the iOS and Android apps provide quite a few options that embrace interactive instruments to trace your money circulate and investments. Monetary advisors can communicate with you about your choices, however you ought to be ready to be offered Empower’s wealth-management companies when you make the most of this characteristic.

You Want a Finances (YNAB)

You Want a Finances (YNAB) offers probably the most versatile mixture of options at wonderful costs. It helps you create an revolutionary and forward-thinking funds in your bills. As well as, it additionally affords the objectives monitoring and reporting instruments to help you in monitoring your enchancment.

Options:

- You’ll be able to join your accounts to your financial institution accounts or manually document transactions.

- Actual-time info is offered by way of any system.

- YNAB will make it easier to to a funds as a substitute of merely automatizing the method.

YNAB is without doubt one of the only software program to handle your funds and take cost of your funds. It affords you the required instruments to make an environment friendly and reliable funds.

The app is constructed on its 4 rules which embrace permitting each greenback to work. The app will make it easier to navigate all of the steps of allocating every greenback to make sure that you spend it properly.

This system’s versatile studies and monitoring of objectives with useful graphs and charts help you in sticking to your funds. YNAB additionally affords a complete training that features greater than 100 on-line lessons and offers real-time updates so that you just at all times know the place your cash’s shifting and you can also make modifications at any time.

PocketGuard

PocketGuard is without doubt one of the finest decisions for school college students because it permits busy college students to see in a single look the sum of money they’ll spend. The aim monitoring options of this system and a easy pie chart might help novices be taught whether or not they’re following their funds. Most of its options are utterly free and excellent for individuals who are on a good funds.

Options

- Most options are free to make use of.

- PocketGuard In My Pocket characteristic immediately will present you the money you possibly can spend.

- Clever algorithms pinpoint areas the place you may save.

For college kids in faculty who aren’t but accustomed to managing their cash, PocketGuard’s straightforward consumer interface and easy-to-read pie charting make it easy to start budgeting and monitoring spending. The PocketGuard In My Pocket characteristic additionally minimizes the possibility of account overdrafts by maintaining a tally of funds obtainable for spending always.

Though the free model doesn’t provide the identical choices because the paid model, college students in faculty will in all probability uncover this system to be sturdy sufficient to keep away from committing to a month-to-month price. Moreover, the algorithms which make it easier to spot and take away undesirable subscriptions might help faculty college students in figuring out alternatives to place more cash into their pockets.

Mint

Mint is the best option for people who find themselves new to budgeting apps. It combines all of your accounts into one place, permits you to hold observe of your internet price, and affords add-ons like accessibility to the ranking in your credit score. Mint simplifies budgeting by enabling you to attach your accounts after which present you the way your spending fares with the nationwide common. These instruments can help you in figuring out when you’re heading in the right direction when simply starting to funds.

Options

- The software program is free to make use of.

- Mint’s monetary dashboard screens your internet price and exhibits all of your accounts in a single place.

- Transactions are routinely labeled.

Mint helps you create your first funds by offering a complete checklist of classes after which displaying a comparability between your funds and the nationwide common. You too can join your accounts with monetary establishments. Transactions are routinely labeled so as to decide whether or not you’re consistent with your spending.

Mint is free and allows you to hold observe of your internet price and monitor your progress towards goals. There are numerous pre-set choices, and though you possibly can select a private financial savings goal, there doesn’t seem like an choice to set mortgage cost as one in every of your goals.

Simplifi

Simplifi is without doubt one of the hottest private finance applications obtainable on-line. It may possibly deal with totally different parts of monetary life, from budgeting to monitoring debt together with financial savings objectives and even funding steerage. This system helps excel exporting which lets you alter and do extra calculations together with your knowledge.

One of many extra subtle options is bill-paying which helps you to pay your payments straight within the software program. It can be used to observe the price of your belongings so that you just be capable of calculate your internet price precisely. This system is highly effective sufficient to deal with your online business and private bills and might even deal with property administration duties like rental funds from the tenant. The software program value is $35.99 and is appropriate with Home windows, macOS, iOS, and Android.

Tiller

Tiller permits you to see all of your monetary info in a single location by routinely updating your bank card, mortgage, funding, and different account info right into a customized Google Sheet or Excel template. Tiller permits you to select from templates that may set up the data for you, or you possibly can personalize your spreadsheet to suit your particular wants.

It additionally sends day by day emails that embrace probably the most present balances and transactions. The associated fee is $79 per calendar yr, which is $6.58 monthly. However you’re capable of benefit from the trial interval of 30 days to find out if it’s the fitting alternative for you.

Cash Dashboard

Cash Dashboard private budgeting software is a extremely efficient instrument for managing your cash. Join your bank cards and financial institution accounts to view all of your financial savings, withdrawal, and spending in a single place with only a single login.

The Cash Dashboard can observe your spending and offer you an total pie-chart that highlights your expenditure on bank cards, consumables, transportation, and different comparable objects. It additionally offers an outline of your steadiness which exhibits the precise quantity of funds obtainable in each account, and you may then examine it to your earlier month’s steadiness to gauge how effectively you’ve managed your funds. It’s a good way to inspire your self.

It’s extremely safe, too. Cash Dashboard locks down your login utilizing the identical diploma of safety as that of your financial institution. And it’s read-only, so your cash is secure. There are apps on Android and iOS, and, extremely, each are free to obtain.

Moneydance

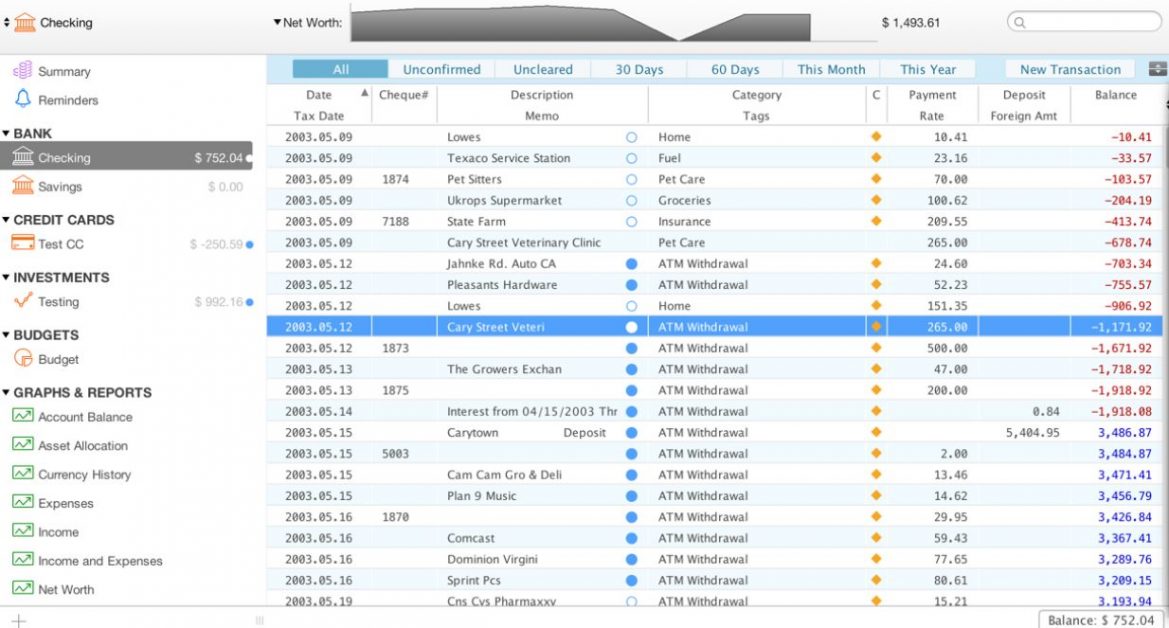

Moneydance is designed to cater to Mac customers (but in addition obtainable for Home windows or Linux). It’s a private monetary administration software with a extremely user-friendly single-window interface. If you set up it, you’ll see a stay view of your funds, future expenditures, and way more. Click on on an merchandise within the left-hand sidebar, and the principle web page will change to replicate the change.

Some of the useful Moneydance options is their account ebook. In case you’re an old school one who used a ebook of cheques, this works equally. You too can use an iOS software that permits you to document transactions whereas on the transfer, which then syncs to the software program that you’ve in your desktop.

Sadly for UK prospects, Moneydance doesn’t assist the protocol for connecting to UK banks, which suggests you’ll must add your transactions manually to make sure you’re up to the mark after which change to your financial institution’s app to switch cash. US customers have all of it protected.

This system is obtainable per family and never per laptop, that means you’re licensed to run this system on a number of computer systems at dwelling. Whereas there isn’t any free trial obtainable, a 90-day return assurance is supplied.

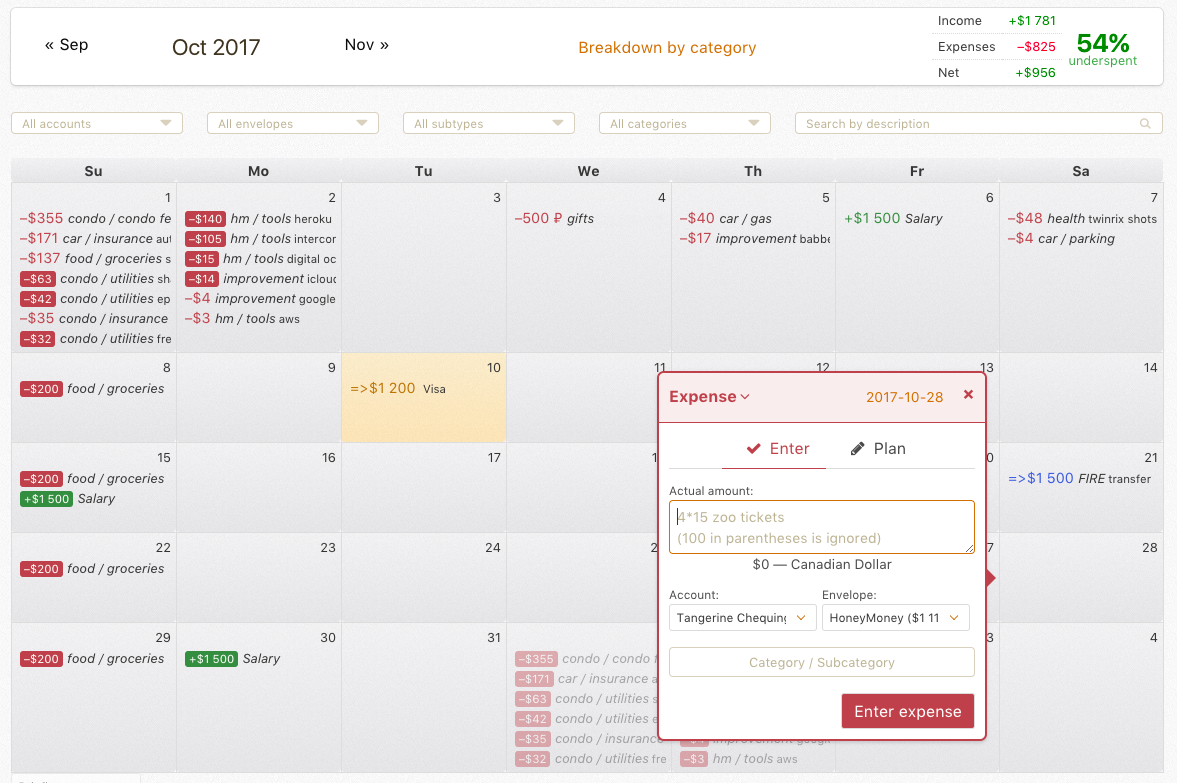

HoneyMoney

HoneyMoney is a safe and secure technique to management funds whereas providing consciousness on habits. The instrument routinely consists of the transaction particulars, categorizes the charts and studies, and shortly enters the outline or quantity. It’s simpler to have unplanned transactions within the instrument and plan the common transactions with the quantities.

The customers can plan their money circulate the bills based mostly on future incomes within the calendar. It additionally stimulates the money circulate based mostly on historical past, giving circulate forecasts to take a position and plan the funds simply. The bills are divided by classes, examine the bills interval, observe the online price, and predict future account balances.

The advantages of utilizing HoneyMoney consists of:

- Monitoring saving charge

- Monitoring and analyzing spends

- Understanding the progress of monetary objectives

- It makes use of 172 currencies that make it versatile to everybody

What are the options I ought to search for in Budgeting Software program?

In case you’re in search of budgeting software program, a very powerful options to contemplate embrace:

Account: Linking your funds, the software program implies that you just don’t must add your transactions to maintain observe of your spending to find out whether or not you’re assembly your funds. Nonetheless, you’ll want your monetary info in order that this system can learn your credit score and financial institution transactions after which mixture the transactions.

Classes for spending: Budgeting software program might routinely categorize your transactions, or you may be required to do it manually. Many of the software program has predefined classes; nonetheless, you’ll even have the choice to outline your personal.

Reporting: It ought to generate graphs and charts that present the patterns of your expenditure.

Different monetary sources: Some applications present free credit score rating tracker, funding monitoring, internet price search, and plenty of extra.

Ultimate Phrases 💰

In distinction to conventional accounting software program, which is concentrated on monitoring what you’ve put into your account or what you owe, the software program for private budgeting is extra forward-thinking. It permits you to allocate your cash earlier than spending it. Use it properly to realize your monetary objectives.