The Ethereum Merge and ETH Triple Halving are the most popular subjects within the crypto group. Let’s check out essentially the most notable Ethereum improve.

As everyone knows, Ethereum is without doubt one of the hottest platforms used to construct, deploy and function decentralized functions (DApps). Ethereum is powered by blockchain expertise and Ether (ETH) is its native cryptocurrency.

So far, 2970 tasks have been constructed on Ethereum, with over 50 million sensible contracts. There are over 71 million crypto wallets with ETH balances. As well as, $11.6 trillion price of worth was moved by the Ethereum community in 2021, bringing $3.5 billion in income to its creators.

Ethereum was first launched by its founder, Vitalik Buterin, in 2014. He revealed an Ethereum Whitepaper, an informative doc highlighting the options of this expertise. As well as, the white paper can also be used as a reference to its customers to replicate the imaginative and prescient of Ethereum and the most recent developments.

Buterin co-launched the Ethereum platform with Joe Lubin in 2015. Ethereum’s Preliminary Coin Providing (ICO) was $0.31 per coin. Compared, ETH is buying and selling round $2,000 on the time of writing. As well as, Ethereum is the second largest cryptocurrency by market worth after Bitcoin.

How does the ETH blockchain work?

The Ethereum blockchain is much like the Bitcoin blockchain in some ways. However the principle distinction is that Bitcoin is taken into account a “first-generation blockchain” with restricted makes use of exterior of transactions. In the meantime, below the “second era blockchain,” Ethereum affords its builders a number of functions to experiment with and run.

The blockchain expertise related to Ethereum distributes an an identical copy of the blockchain all through the community. Your complete system is validated utilizing a consensus mechanism that’s immutable. At the moment, Ethereum makes use of a proof-of-work (PoW) protocol, also referred to as Ethereum mining.

The community individuals, often known as miners, use software program to show the validation of encrypted numbers after a transaction. The miner who manages to show the validity of the encrypted quantity will likely be rewarded with Ether.

What’s the Ethereum Merger?

The Ethereum Merge is essentially the most mentioned and debated matter within the crypto house. Merely put, ETH or Ethereum Merge is the continuing transformation of Ethereum’s consensus mechanism from present proof-of-work to proof-of-stake. This transformation goals to handle the problems dealing with Ethereum associated to scalability, energy consumption, and effectivity.

Absolutely you’re curious concerning the date of this historic occasion, proper? You do not have to attend for much longer because the merge is scheduled for September 15, 2022. This upcoming schedule brings nice satisfaction to those that have been ready for the previous few years.

Let’s be taught extra concerning the Ethereum Merge utilizing the principle parts related to the Merge occasion.

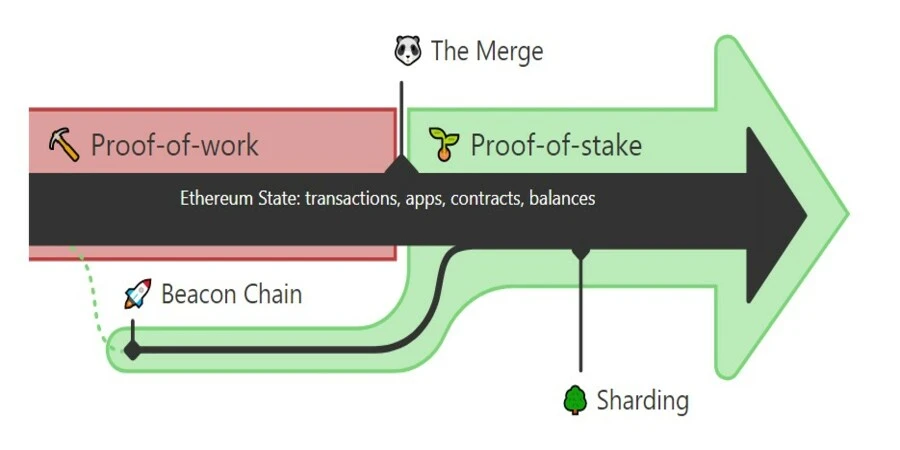

#1. beacon chain

The Beacon Chain is a parallel developed community chain that capabilities alongside the Ethereum mainnet. This chain got here into impact in 2020. The proof-of-work mechanism has been examined on the Beacon Chain. The testing section may be very essential for Ethereum earlier than the merger. In the course of the testing interval, extra validators have been concerned in bettering Ethereum’s proof-of-stake consensus mechanism.

The Beacon Chain alone can not handle Ethereum sensible contracts. The Beacon Chain is thus used to ascertain the performance of the proof-of-stake mechanism.

#2. Merge Ethereum

The Beacon Chain we mentioned above should merge with the Ethereum mainnet to finish the Ethereum merger.

Throughout this course of, your complete Ethereum community is transformed into its proof-of-stake mechanism. In depth exams are carried out prematurely to eradicate all errors.

#3. Shard chains

Lastly, shard chains are being carried out to substantiate Ethereum’s scalability enchancment. Shard chains are the extra chains used to flow into the transactional payload of the community. As well as, these chains additionally allow extra information over the community.

Initially, shard chains have been deliberate to be achieved earlier than the Ethereum merger. In distinction, the Ethereum customers determined to give attention to the Merge occasion. The implementation of shard chains completes the entire and is predicted to happen round 2023.

What precisely is a crypto halving?

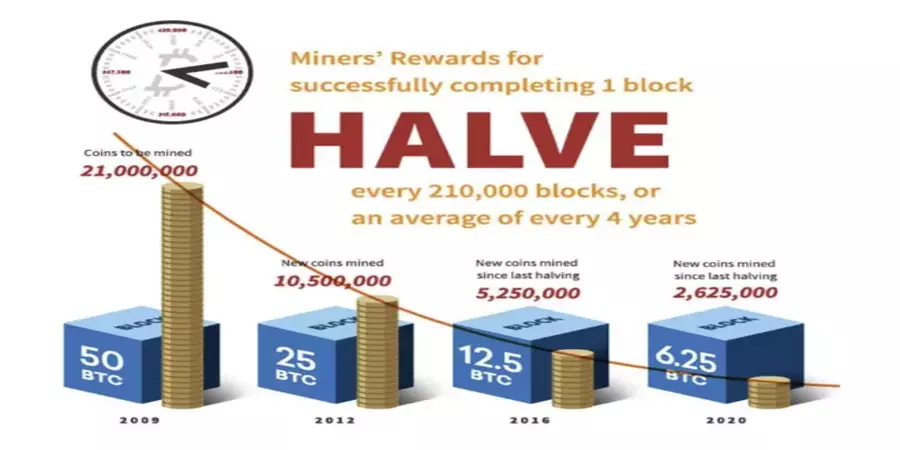

A halving is a deflationary occasion associated to the blockchain. On this case, the rewards for the validators are halved. The Bitcoin halving is the most well-liked within the crypto house.

For instance, let’s take the case of Bitcoin. A Bitcoin halving takes place as soon as each 4 years. This halving occasion works in accordance with this system till the final Bitcoin is mined round 2040. Bitcoin’s subsequent halving is scheduled for March 2024.

Bitcoin halving is an actively mentioned matter, however different cryptocurrencies akin to Litecoin, Bitcoin SV, and Bitcoin Money are additionally present process halving. In distinction, the schemes of those cryptocurrencies differ from these of Bitcoin.

So, whereas retaining the cryptocurrency halving in thoughts, let’s check out the triple halving.

What’s Triple Halving?

The ETH distribution below the proof-of-work protocol is barely totally different from the Bitcoin halving. Ethereum’s algorithm doesn’t scale back the ETH rewarded to miners. The method is carried out utilizing software program updates authorized by the Ethereum group.

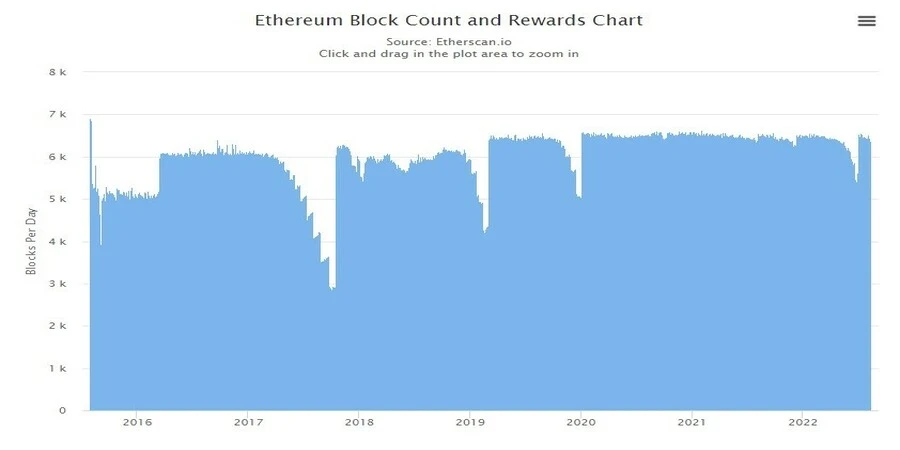

The members of the Ethereum group dubbed the occasion “The Triple Halving.” This ETH issuance will happen as soon as the “ETH Merge” takes place. In keeping with present information, a median of 6,500 new ETH blocks are mined every day. Thus, the merge will increase the rewards of the miners.

The three foremost parts concerned in ETH’s triple halving are:

#1. Vital drop in ETH distribution

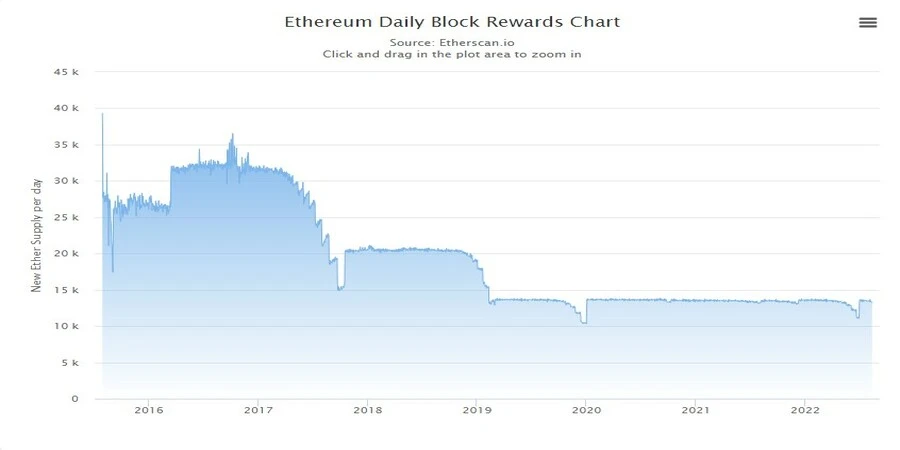

Ethereum points about 13,500 ETH per day, with an annual issuance of about 4.3% of the whole provide of ETH. With the proof-of-stake (PoS) issuance, annual issuance is predicted to fall between 0.3% and 0.4%.

The year-on-year drop in issuance additionally reduces promoting nervousness amongst ETH miners. In the end, the easing of promoting strain additionally helps drive up the value of ETH. The section of the Ethereum financial system is regularly shifting from the persistent ‘mining and dump’ to the ‘stake and re-stake’ financial system.

#2. Burn ETH with EIP-1559

EIP-1559 is a serious software program replace used to enhance Ethereum’s price system. EIP stands for Ethereum Enchancment Proposal or London Exhausting Fork Replace. EIP-1599 was carried out within the Ethereum system as a mechanism to introduce base price burning.

Earlier than Ethereum’s EIP-1599 implementation, many different cryptocurrencies akin to Polygon added this replace to their system. Beforehand, the person needed to pay a primary price which was transferred to the miners. However utilizing EIP-1599, the bottom price within the circulating ETH provide drops and will increase its worth.

In brief, EIP-1599 improves the Ethereum person expertise. Together with the customers, the miners’ revenues have additionally skyrocketed. As well as, the options of the EIP-1599 system scale back the danger of community assaults.

#3. Guess Ethereum

Ethereum staking is depositing ETH and receiving a reward (present APR ~4.1%). Beacon Chain introduces the upcoming proof-of-stake. Along with being rewarded, ETH stakers can reap the advantages of higher safety. Take a fast take a look at crypto staking for a greater understanding.

Because the variety of ETH stakers will increase, the Ethereum community turns into stronger and fewer viable for assaults. If somebody must assault the community, they need to cease many of the miners, ruling out the potential for assaults.

In comparison with proof-of-work, proof-of-stake doesn’t require complicated system necessities. This profit permits customers to take part in proof-of-stake utilizing a regular pc or smartphone. Furthermore, staking saves vitality consumption, making Ethereum extra environmentally pleasant.

Customers also can use totally different betting choices relying on their comfort. The choices accessible for staking Ethereum are:

- Soloing out at house

- Disable as a service

- Pooled strike

- Centralized exchanges

It’s good to deposit 32 ETHs to make use of ‘Staking as a Service’ and ‘Solo house staking’. Not snug betting 32 ETHs? Then you should utilize “Pooled staking” and “Centralized exchanges” for decrease ETH stakes.

Staking entails danger, and it’s best to choose your betting choices rigorously.

How does the triple halving have an effect on ETH shortage?

With the implementation of proof-of-stake, promoting strain is predicted to lower by nearly 30%. The proof-of-stake mechanism encourages the miners to promote ETH as quickly because the reward is acquired. Alternatively, proof-of-stake and triple halving encourage miners to make use of their ETH rewards for staking actions.

The triple halving, which is sort of equal to a few Bitcoin halvings, lowers ETH inflation from 4.3% to 0.43%. Other than that, the every day block reward can also be lowered to one-tenth.

In abstract, the triple halving of ETH ends in:

- Excessive community stability.

- Safer and secure community.

- Elevated shortage for ETH.

- Much less vitality consumption.

Conclusion

The Ethereum Merge is undoubtedly the most important improve within the historical past of the crypto house. The Ethereum group may be very optimistic concerning the consequence of this merger.

After the most important merge, Ethereum will develop into extra scalable, safer, and eat much less vitality. However as individuals count on, this merger won’t decrease fuel charges. Apart from that, the merge additionally would not enhance Ethereum’s present transaction pace.

If you’re an ETH holder, you do not want to take any motion throughout or after the merger. As a result of the improve relies on the protocol, there will likely be no direct influence on the holders or customers. All you must do is sit again, loosen up and witness this historic occasion.

Additionally try a number of the finest Ethereum wallets.